Online personal loans are increasingly becoming the go-to option for consumers keen on borrowing money swiftly and conveniently. Procuring the desired funds has never been easier with the advent of financial services offering the choice to apply for a personal loan online. Nevertheless, one must know this digital platform’s inherent risks and downfalls.

The all-encompassing guide plunges into the intricacies of the online personal loan universe; it probes into the ascension of digital lending, the merits and drawbacks of borrowing from personal loan lenders online, and tips for secure borrowing. It throws light on alternatives to high-interest loans. Use the insightful resource to make the most decisions for your financial state whenever you’re taking a personal loan online apply.

The Explosive Growth of Online Personal Loans for Bad Credit

Online lending, a disruptive byproduct of financial technology (fintech) companies, has revolutionized how consumers access credit and procure money. Prior to the flux of the early 2000s, obtaining a personal loan required booking an appointment with a local bank, slogging through a pile of paperwork, and enduring an excruciating wait for approval. The process usually dragged on for several days or even weeks.

Things took a turn for the better with the surfacing of novel peer-to-peer personal loan lenders, which eliminated banks as the middlemen. They ensnared individual and institutional investors, connecting them directly with people who wished to apply for personal loan online via digital marketplaces. One completes the entire lending process digitally in less than 24 hours.

“We saw an opportunity to leverage technology to make affordable credit more accessible for consumers and investable for institutions,” as LendingClub founder Renaud Laplanche stated.

These platforms dish out more favorable personal loan rates, quicker approvals, and significantly larger loan amounts to a wide spectrum of borrowers, owing to their lower overheads, allowing them to pass on cost savings. Consequently, this has led to the popularity of small personal loans online and even online personal loans for bad credit.

The business model swiftly piqued the interest of consumers and investors. The explosion of online lending in the 2010s and 2020s was clear evidence of this. In 2021 alone, online lenders were responsible for issuing an estimated $93 billion in personal loans – a hefty figure representing over 40% of total personal loan amounts, according to TransUnion.

The COVID-19 pandemic only heightened the trend towards digital lending with the increase of loan options available. As physical bank branches had to shutter temporarily, there was a noticeable surge in people who took personal loan apply online. Given its vast reach and undeniable flexibility, it is easy to anticipate that online lending continue its powerful trajectory in reshaping how consumers borrow money.

Online Personal Loan Apply: Business Models

In general terms, they all fall under the umbrella of “online lenders,” there are a few distinct business models companies in this market adopt:

- Peer-to-peer (P2P) lending – A model where loans are directly facilitated between individual borrowers and investors through an online platform. Pioneers of this model.

- Balance sheet lending – The platform entity directly issues loans using institutional capital instead of individual investors. SoFi and Best Egg are two familiar names in this strategy.

- Bank partnerships – In this model, fintech companies form partnerships with banks or credit unions, who formally issue the loans. Upstart and LendingPoint are among the people who utilize this strategy.

- Marketplace lending – A hybrid model that borrows elements from individual and institutional investors to financially back loans. Among this mix, you’ll find Avant Credit.

Despite the smooth and hassle-free online application process as seen by borrowers, the sources and mechanisms behind online lending greatly differ between platforms, especially at the time of application.

Are you in need of financial assistance but struggling with a less-than-perfect credit score? PaydayDaze is dedicated to providing accessible personal loans for individuals with bad credit nationwide. Below, you’ll find a comprehensive list of American states where we are actively serving, offering you the opportunity to access the financial support you need, regardless of your credit history. Discover the availability of personal loans in your state by referring to the table below.

| Alabama | Alaska | Arizona |

| Arkansas | California | Colorado |

| Connecticut | Delaware | District Of Columbia |

| Florida | Georgia | Hawaii |

| Idaho | Illinois | Indiana |

| Iowa | Kansas | Kentucky |

| Louisiana | Maine | Maryland |

| Massachusetts | Michigan | Minnesota |

| Mississippi | Missouri | Montana |

| Nebraska | Nevada | New Hampshire |

| New Jersey | New Mexico | New York |

| North Carolina | North Dakota | Ohio |

| Oklahoma | Oregon | Pennsylvania |

| Rhode Island | South Carolina | South Dakota |

| Tennessee | Texas | Utah |

| Vermont | Virginia | Washington |

| West Virginia | Wisconsin | Wyoming |

Benefits of Small Personal Loans Online

Among the compelling benefits, the opportunity to get a personal loan apply online includes:

Convenience

Online applications are highly accessible and are completed at any time of application day from anywhere you have an internet connection and device. The traditional requirements of scheduling appointments with loan officers or visiting physical bank branches instantly become obsolete.

Speed

The entire lending procedure is significantly expedited with the feasibility of instant approval after the online application process.

Many online lenders advertise approvals and access to loan proceeds in as little as 5 minutes and same-day funding if credit approval is granted. Rather than waiting days or weeks, funds are quickly deposited directly into your bank account once approved.

Accessibility

Online lenders generally use algorithmic approvals based on proof of income, employment, and other factors, which expands access to Personal Loans for people with limited credit history or lower credit scores. The majority even execute a soft credit inquiry, which doesn’t impact your credit score, making Unsecured loans more accessible.

Lower Interest Rates

Online lenders pass on cost savings with more competitive interest rate with leaner operations than legacy banks and credit unions, which implies lowered loan payments for the borrower. It is necessary to compare different offers before selecting any lender and guarantee that the interest rate is reasonable and within your budget.

| Lender | Rate Range | Loan Amount | Credit Check? |

|---|---|---|---|

| LendingClub | 6.95% – 35.89% | $1,000 – $40,000 | Yes |

| Prosper | 6.95% – 35.99% | $2,000 – $40,000 | Yes |

| Upstart | 6.5% – 35.99% | $1,000 – $50,000 | Yes |

Note: Rate ranges are estimates; actual rates depend on individual factors.

Lenders reduce loan payments by connecting loan proceeds directly to borrowers from investors, which allows for providing lower-rate offers.

Table of Fees and Charges: Understanding APRs and Loan Fees

It’s necessary to look beyond the interest rate and examine the total cost of borrowing when comparing loan options. The annual percentage rate (APR) takes into account both the interest rate and any fees associated with the loan, according to Bankrate. You get a better sense of the long-term cost of each loan option by comparing APRs.

The table below illustrates this concept with two hypothetical $5,000 loans with a five-year repayment term. Loan #1 has an interest rate of 6.25% and no origination fee, while Loan #2 has a lower interest rate of 5.5% but charges a $100 origination fee. Loan #2 has a slightly higher APR of 6.32% due to the added fee despite the lower interest rate. The numbers show how a loan that charges a fee is similar in cost to one that doesn’t over the long term.

Understand how fees are paid. In many cases, loan fees are deducted from the funds you borrow, meaning you will receive less than the loan amount you applied for. It’s necessary to consider fees when determining how much you need to borrow so you don’t take on extra debt.

It’s worth noting that some personal loan lenders do not charge any fees. Check out guides to the best and no-fee personal loans to find the options. You make an informed decision and choose the right loan option by comparing APRs and understanding how fees work.

| Loan Option | Interest Rate | Origination Fee | APR | Monthly Payment |

|---|---|---|---|---|

| Loan #1 | 6.25% | $0 | 6.25% | $97.25 |

| Loan #2 | 5.5% | $100 | 6.32% | $95.51 |

Risks and Downsides of Applying for a Personal Loan Online with Bad Credit

Personal Loans obtained online offer tempting advantages like speed and convenient access, but they have risks and drawbacks, especially around credit card debt and how to manage it:

Higher Interest Rates for Riskier Borrowers

Personal Loans marketed as “no credit check” or “guaranteed approval” charge very high-interest rates and fees to offset the risk of lending to applicants with poor credit or income, leading to escalated credit card debt. These loans must be an absolute last resort option due to their potential impact on your debt levels.

Predatory Lending Practices

The online lending space attracts predatory lenders who use deceptive marketing, opaque loan terms, and unreasonable policies, all aimed at trapping borrowers in perpetual cycles of credit card debt. Borrowers must be exceptionally vigilant against such unscrupulous practices.

Privacy and Security Concerns

Providing your financial profile and personal information carries privacy risks. Not all lenders offer flexible terms, and while reputable ones utilize encryption and data security safeguards, any activity online nevertheless involves certain vulnerabilities to breaches.

Overborrowing Risks

The simplicity and speed of online borrowing make it tempting to seek out larger loans with higher balances and minimum loan thresholds. However, securing a larger loan than you reasonably can repay leads to a precarious financial history.

Online lenders provide greater access to various credit types, broadening your options for the best personal loans; the downsides mean borrowers must strive to make financially responsible decisions. Alternatives like nonprofit lenders or secured loans are more accommodating, depending on your situation.

Alternatives to High-Interest Personal Loans Apply Online

There are several other avenues for securing a loan you must explore before settling for a high-cost online loan if your credit score or income ratio makes it difficult to qualify for favorable rate loans online:

Federal Credit Union Personal Loans

Many credit unions offer personal loans, with maximum rates capped at 18%. Their lower overhead costs enable them to offer rates as low as 6%. Credit union membership is determined by employer, geographic area, or affiliation factors – instead of your excellent credit status.

Secured Personal Loans

Secured loans necessitate an asset like a vehicle or savings account as collateral. The decreased risk for the lender allows them to offer lower rates. It encourages you to make your payments on time to avoid losing your collateral. Rates for secured loans start under 10%.

Credit Builder Loans

Programs like credit builder loans are designed with the express purpose of aiding you in establishing a credible credit history and score. They provide affordable loan amounts and terms tailored to enhance your credit profile’s state.

Employer or Nonprofit Assistance

Other employers, charities, churches, and nonprofits extend low or even no-interest loans to individuals tackling expenses that a high-interest online loan covers, which is a preferable route if you’re striving to maintain an excellent credit status.

The options provide affordable alternatives with direct payment that won’t trap you in an expensive debt cycle even with a poor credit history, while less convenient than instant online loan approvals with no credit check.

9 Tips for Safe Online Personal Loan Apply with No Credit Check

Take caution and follow the simple steps to undergo a process if you decide to apply for an online bad credit loan:

1. Compare quotes from at least 3 direct lenders

Compare loan specifics like lowest interest rates, tenures, and fees across various direct lenders. Platforms and other loan marketplaces simplify this surfing process.

2. Read all loan terms closely before accepting

Avoid glossing over the details. Comprehend the loan amount, the interest rate, the payment schedule, and all late payment fees and policies before affixing your signature.

3. Research lender reviews and complaints

Investigate the Consumer Financial Protection Bureau and other watchdog websites to uncover common issues with specific lenders before applying, which is useful financial advice.

4. Beware of extra upsells during applications

Many lenders aggressively advertise add-ons like credit insurance during applications. Decline to evade charges that add little to no value.

5. Understand the impact of late payments

Online lenders are able to report late payments to credit bureaus. Understand how this impacts your credit score if you miss due dates of payments.

6. You must afford the repayment.

Only borrow what you conveniently afford to pay back on terms while still having enough to cover regular expenses.

7. Avoid payday and high APR lenders

Steer clear from lenders who vigorously advertise no credit check or guaranteed approval loans as their rates reach astronomical scales.

8. Don’t borrow more than you need

It’s compelling to borrow the maximum amount offered but control borrowing to only what you require to evade overextending your finances.

9. Use autopay if offered

Register for automatic payments directly from your bank account to avoid missed payments and penalties. The payment amount must be manageable.

Following the tips diligently supports prospective borrowers in assuring a seamless, financially adept online lending experience. Evade threats like exploitative lenders and resist the urge to borrow more than you need.

What Information Do Direct Lenders Require for Personal Loans Online?

To complete the application, online lenders require sundry personal, employment, and financial details:

- Full legal name and contact info – It validates the potential borrower’s identity. Lenders necessitate a copy of your driver’s license or passport.

- Date of birth – Verify your age in compliance with lending requisites.

- Social Security number – Lenders use your SSN to fetch your credit reports and confirm income through employment.

- Employment details – Details such as your employer’s name, tenure at work, wage, and position are compulsory.

- Income – Lenders need an affirmation if you make enough monthly remunerations to handle your loan repayments. Proof in the form of pay stubs, tax receipts, or bank statements is solicited.

- Monthly expenses – Enumerating rent/mortgage, debt, and other monthly costs aid in assessing your capability to make payments, which is especially pertinent for bad credit borrowers.

- Bank account information – Sharing your checking account and routing number paves the way for funds to be deposited into your account after approval.

Esteemed lenders utilize encryption to guard your data. One must still tread carefully when supplying delicate, personally identifiable information online.

The Process to Apply for a Personal Loan Online with Guaranteed Approval

The application for an online personal loan entails the following steps:

- Prequalify – Major lenders allow a preliminary qualification round with a soft credit check, which does not dent your score, which is especially necessary to comprehend your credit usage and estimated chances of approval.

- Complete application – Submit the required personal, employment, and financial specifics outlined above.

- Review offers – Once approved, evaluate the types of loans and their offers from various lenders you have applied with.

- Accept loan terms – Peruse the loan agreement cautiously, consulting with financial experts if needed, and digitally endorse the agreement if you accept one of the offers.

- Verification process – Lenders insist on supporting documentation like pay stubs before final approval. The verification assures your access to funds and is particularly imperative in scenarios such as covering medical expenses.

- Funding – Upon approval, your fast personal loan funds are efficiently disbursed, with same day deposit becoming available within 1 business day into your linked bank account.

- Repayment – Depending on your selected flexible repayment terms, your payments are made automatically from your account, thereby ensuring you experience reduced financial stress.

The smooth-flowing process from application to being granted financial products wraps up in minutes or one hour, exemplifying the swift funding times associated with online lending.

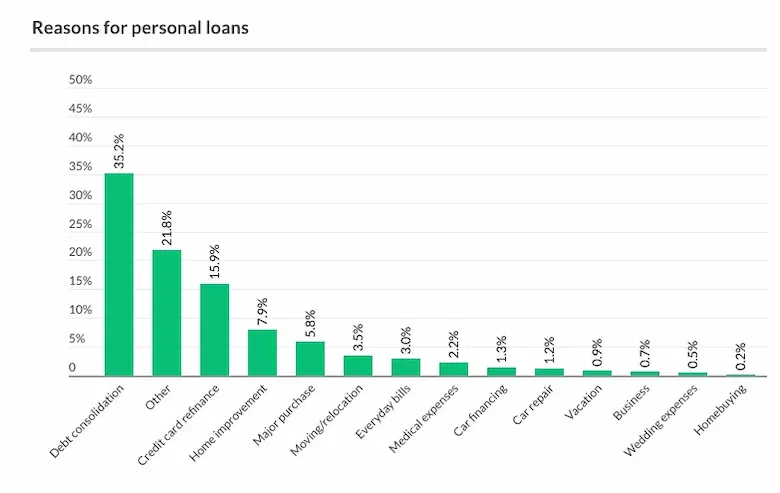

Common Reasons to Apply for a Personal Loan Online Same-Day

Despite individual differences, common uses for online personal loan funds are as follows:

- Credit card consolidation – Employing a lower-rate online personal loan for financing methods to refinance burgeoning credit card balances.

- Major purchases – Expenditures such as home improvement, medical procedures, or holiday financing methods.

- Life events – Managing financial difficulties connected with large moments like a wedding, relocation, expanding family, etc.

- Emergencies – Tackling unexpected emergency expenses such as unexpected medical bills, home repairs, legal expenses, or a sudden pause in income. A payday loan is also helpful to cover emergency expenses.

- Small business – Personal installment loans are helpful when managing larger expenses such as funding inventory, equipment, marketing, or other startup costs for a small business venture.

- Continuing education – Paying for extra job training, professional certification, or college courses. These require a good investment, for which installment loans with flexible payment options ease the financial burden.

- Debt consolidation – Combining multiple high-interest debts like payday loans or bills into one manageable payment is a wise decision, especially if you have bad credit and plan to improve it over a period.

The decision to take a personal loan, which offers a wide range of uses, must never be made lightly. Your reasoning must align with the responsible use of funds that you realistically repay on time through shorter repayment terms, minimizing interest.

Alternatives to Online Personal Loans for Bad Credit

Beyond online options, consumers in need of funds do have other borrowing alternatives featuring low interest and even fair credit decisions:

- Friends or family – For people with close social connections able to directly lend money, this is a viable option, avoiding the formalities of loan interest and fees.

- 401k loan – It allows borrowing against yourself while repaying the loan via payroll deductions. It reduces retirement savings.

- Home equity loan – Unlocks funds based on home equity value, usually with low interest. Rates are lower than personal loans, but you risk your home if you cannot repay it within the allotted time.

- Traditional bank loans – Local banks or credit unions with physical branches offer personal loans with the benefit of in-person service. They have stricter approval requirements.

- Credit cards – Putting purchases on a credit card is an option, but only if you reliably pay off the balance each month. The interest in carrying a balance is higher.

- Emergency cash advances – Emergency cash advances offer rapid access to funds in situations requiring immediate financial assistance, such as unexpected job loss or urgent car repairs. These advances typically involve small sums, usually capped at $500, but they often come with higher-than-average fees. Therefore, it’s vital to conduct thorough research and comparisons before deciding to utilize them.

Depending on your financial resources, one of the loans is a preferable option to an online loan. Every lending decision merits careful thought.

Key Takeaways: Safely Apply for a Personal Loan Online with Bad Credit

- Online lending provides the advantages of fast personal loans setup, convenience, expanded access, and potential cost savings. It becomes high risk personal loans if you lack caution since it comes with significant risks.

- Borrow only what you realistically afford to repay on time to avoid credit damage or becoming victim to predatory debt cycles, which is necessary, especially if you’re looking for $5000 dollar personal loans.

- Be careful before settling for a high-interest loan targeted at borrowers with poor credit or low income if you lack of credit history. You want to examine alternatives like secured loans or bad credit lenders.

- You must follow tips like comparing direct lender rates and fees, reading terms closely for favorable terms, using autopay, and borrowing only essential amounts.

- Do thorough research on lenders and be vigilant against deceptive marketing or loan offers touted as high risk personal loans guaranteed approval direct lenders that seem too good to be true.

Frequently Asked Questions – Online Personal Loans for Bad Credit with Direct Lenders

What credit score is needed for an online personal loan?

Minimum credit scores vary between lenders but fall in the 600 to 720 range. Those with poor credit pay higher interest rates or do not qualify with reputable lenders.

How long does it take to get loan funds once approved?

The major benefit of online lending is fast personal loans funding. Most direct lenders deposit approved loans into your bank account within 1-3 business days.

Where am I able to get a personal loan with no credit check?

True, no credit check loans are rare and predatory. Legitimate lenders still perform a soft inquiry that doesn’t damage your score. Avoid any lender advertising high risk personal loans guaranteed approval, especially if you have a lack of credit history.

Are there personal loans for people on Social Security or disability?

Other online direct lenders approve loans based mainly on fixed-income sources like Social Security. But expect higher rates and costs due to risk. Bad credit lenders like payday lenders must be avoided.

How am I able to get a $5,000 dollar personal loan fast?

Matching services like MoneyMutual or CashUSA allow comparing $5,000 loan offers across multiple lenders to expedite the approval and funding process. Stay cautious of high risk personal loans with very high interest rates.

What is the easiest personal loan to get approved for?

The easiest loan to get approved for, even with a lack of credit history, is an emergency personal loans. Bad credit lenders grant the loans, but be sure to compare rates to receive the lowest rate.

Secured loans backed by an asset you pledge for collateral have simple qualification requirements. A good example is a share secured or share certificate loan from a credit union is one of the easiest assets to qualify for, which stands true even if you are looking for specific loan amounts like $3000 dollar personal loans or $2000 dollar personal loans.

Am I able to get two personal loans at the same time?

Yes, most lenders allow you to have multiple personal loans concurrently. You potentially secure a $1000 dollar personal loan and a $4000 dollar personal loan on the same day if needed. It’s necessary to evaluate if you afford the total monthly payments for both loans to help you avoid falling into a loan default, especially if you’re dealing with emergency costs.

What happens if I default on an online personal loan?

It results in penalties and fees and damages your credit score if you default on your loan. The loan is sent to collections, subjecting you to legal action wage garnishment. You must face continued harassment from debt collectors.

Is there a legitimate way to get a personal loan with bad credit?

Yes, there is! Federal credit unions offer personal loans at reasonable rates. The lender differences do not significantly alter even for borrowers with poor credit, providing 2-7 year terms and a flexible range of loan amounts. Try secured or credit builder loans specifically designed for people looking to improve their credit.