A loan request for a $500 payday loan through our network of lenders may provide fast results, giving you access to funds before payday when an unexpected expense arises and your bank account runs low. These short-term loans, often referred to as bad credit payday loans, typically welcome all credit types—meaning lenders may perform a credit review—making it possible to qualify even with a poor credit score. However, please note that approval is not guaranteed, and such access to funds comes with corresponding risks related to loan costs that borrowers should consider.

This detailed guide helps you navigate the complexities of $500 payday loans with all credit types welcome, offered through our network of online lenders, so you can make an informed loan decision.

What is a 500 Dollar Payday Loan with All Credit Types Welcome?

A payday loan represents a loan type that offers quick funds to be repaid around your next paycheck. Known as a cash advance and a short-term loan, payday loans enable immediate access to funds within a concise time frame.

To qualify, requirements include a government-issued ID, proof of a source of income, and an active bank account. You may be required to provide a postdated check that will be processed on your next payday. The ease of the online loan request process comes with the drawback of high-interest rates and fees.

Even though payday loans can help overcome temporary financial difficulties, they may also trap borrowers in challenging debt cycles if used improperly. Hence, understanding the risks upfront is necessary.

PaydayDaze takes pride in serving customers across a range of states, providing accessible financial solutions when needed most. Below is a comprehensive list of the American states where our company is actively offering $500 payday loans with all credit types welcome. Whether you’re facing an unexpected expense or need a bit of extra help between paychecks, our services are designed to provide quick and convenient assistance.

| AL (Alabama) | AK (Alaska) | AZ (Arizona) |

| AR (Arkansas) | CA (California) | CO (Colorado) |

| CT (Connecticut) | DE (Delaware) | DC (District Of Columbia) |

| FL (Florida) | GA (Georgia) | HI (Hawaii) |

| ID (Idaho) | IL (Illinois) | IN (Indiana) |

| IA (Iowa) | KS (Kansas) | KY (Kentucky) |

| LA (Louisiana) | ME (Maine) | MD (Maryland) |

| MA (Massachusetts) | MI (Michigan) | MN (Minnesota) |

| MS (Mississippi) | MO (Missouri) | MT (Montana) |

| NE (Nebraska) | NV (Nevada) | NH (New Hampshire) |

| NJ (New Jersey) | NM (New Mexico) | NY (New York) |

| NC (North Carolina) | ND (North Dakota) | OH (Ohio) |

| OK (Oklahoma) | OR (Oregon) | PA (Pennsylvania) |

| RI (Rhode Island) | SC (South Carolina) | SD (South Dakota) |

| TN (Tennessee) | TX (Texas) | UT (Utah) |

| VT (Vermont) | VA (Virginia) | WA (Washington) |

| WV (West Virginia) | WI (Wisconsin) | WY (Wyoming) |

How Do 500 Dollar Online Payday Loans Work for Bad Credit?

Requesting a $500 payday loan is uncomplicated:

You submit an online loan request via a website of a network payday lender, providing personal details and your source of income.

The lender reviews your loan request and, if you meet their criteria, may quickly provide an option for up to $500—regardless of your credit score. Please note that approval is not guaranteed and is subject to individual lender review.

You provide a postdated check or consent to give the lender access to your bank account for $500 plus the lender’s fees, which will be processed around your next payday.

The lender promptly extends you a loan in the form of a direct deposit of $500, conveniently offering payday loans online with funds deposited by the next business day upon lender’s approval.

On the due date, the lender processes your check or debits your bank account for the $500 repayment along with applicable fees, with repayment made in a single lump-sum payment rather than in monthly installments.

The step-by-step process paves the way for a quick and smooth loan request process. It’s important to understand the associated fees and high interest rates tied to urgent loans for bad credit, known as bad credit payday loans online or cash advance payday loans.

The potential to alleviate emergency expenses makes these loans attractive, but you may find yourself trapped in a cycle of payday installment loans with hefty repayment amounts if you don’t have $500 available when repayment is due. Lenders in our network cater especially to people with a poor credit history, offering an online loan service that may seem like the only solution.

The Financial Implications of a 500 Dollar Payday Loan with All Credit Types Welcome and Next Business Day Funding

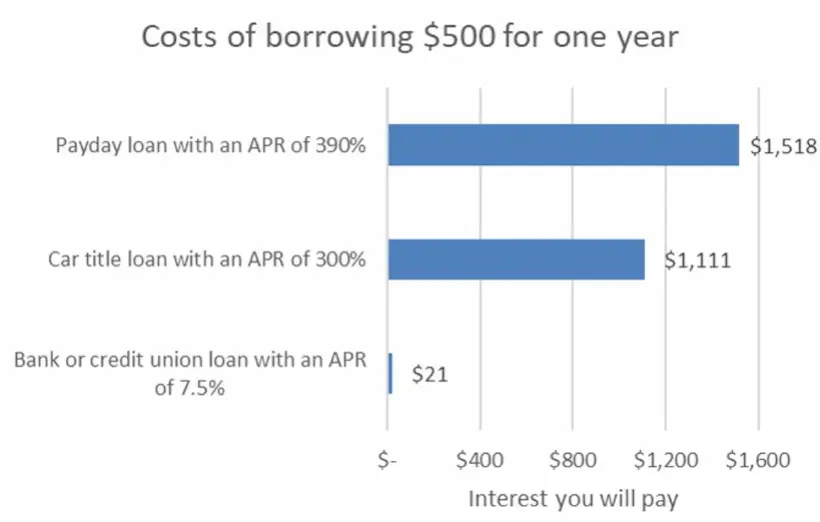

A $500-dollar loan becomes exceedingly expensive, particularly if it isn’t repaid promptly. Here are the ordinary costs associated with quick payday loans:

- Interest rates: 300-400% APR is common. For a small payday loan online with all credit types welcome, this equates to over $50 in interest.

- Fees: Lenders impose origination and documentation fees of up to $30 per $500 borrowed.

- Rollover fees: Extended loan terms from payday loan deferrals can cost you $50+ per $500 borrowed. Costs pile up quickly.

- NSF fees: You may incur NSF charges up to $35 from both the bank and lender if your account lacks sufficient funds.

- Collections costs: Leaving an outstanding balance may result in collection agencies adding extra fees, and nonpaid loans can lead to lawsuits.

The table examines the charges associated with payday loans and how they can quickly accumulate, making them a risky financial option, according to Bankrate.

| Type of Fee/Charge | Description | Amount |

|---|---|---|

| Interest Rate | The percentage charged on the loan | 150% – 650% or more, depending on the state of residence |

| Application Fee | Fee charged when applying for the loan | Varies by lender and state |

| Origination Fee | The fee charged for processing the loan | Varies by lender and state |

| Late Payment Fee | Fee charged for late payment of the loan | Varies by lender and state |

| Rollover Fee | Fee charged for rolling over the loan to a new term | Varies by lender and state |

| Collection Fee | The fee charged for sending the loan to a collection agency | Varies by lender and state |

Know all costs when deciding if online payday loans for bad credit suit your budget. Fees and interest can exceed the original amount of a payday advance loan online if not repaid by the predetermined due date.

Payday Loan Requirements for Potential Approval of a 500 Dollar Payday Loan Near Me

To be eligible for these payday loans, lenders typically require the following eligibility criteria:

- A government-issued photo ID showing you’re at least 18 years old

- Social Security Number

- An active checking account where the funds are transferred

- A stable source of income – whether from a job, benefits, etc.

- Up-to-date contact information, such as a working phone number and email address

Provided you have the required documents, a seamless online loan request process may yield fast results. Lenders will verify your income by asking for pay stubs, tax forms, bank statements showing consistent deposits, or other documentation—helping them make informed loan decisions regarding your ability to repay.

Repaying Your 500 Dollar Payday Loan from a Network Lender

Repaying your online payday loan on time is not only a legal obligation stated in your loan contract but also a necessary step to avoid further financial emergencies. Therefore, opting for a payday loan request should only be considered after exploring all other alternative sources.

Remember that while a user-friendly online platform can simplify the loan process, extreme caution is necessary when dealing with payday loan requests that appear to offer instant approval. It is recommended to consider a $500 loan only for non-recurring bills or emergencies, rather than as a long-term financial solution.

Understand the payday loan repayment terms before requesting loans with funds deposited by the next business day, such as small payday loans or 500-dollar loans. Most traditional lenders or network lender loan providers process the loan requests and automatically process the postdated check or debit the repayment directly from your bank account on the agreed due date. Unlike monthly payment plans, you must repay the full loan amount plus all accrued fees and interest in a lump-sum payment.

You may incur NSF fees or face collections actions if your bank account lacks sufficient funds. Having a bad credit score does not necessarily prevent you from obtaining a payday loan, unlike loans from traditional lenders that rely on credit reports from major credit bureaus. There are options for payday loans without a bank account and for loans that welcome all credit types, but be wary of the associated high rates.

Lenders may allow you to roll over a loan into a new term with extra fees if you can’t afford to repay the full amount when due, which can trap you in an expensive cycle of debt that is difficult to escape.

Dangers and Debt Traps of 500 Dollar Payday Loans for Bad Credit with All Credit Types Welcome

Quick online payday loans or online loans that provide fast funds access, small-dollar loans, or even emergency payday loans pose risks:

- Astronomically high APRs can make small-dollar loans or so-called low interest payday loans truly expensive.

- Short-term payday loans often risk not being repaid on time.

- Rolling over loans leads to accumulating late repayment fees and growing debt.

- The possibility of aggressive collections practices from lenders.

- Bank penalties from overdrafts if funds are not available on the due date.

- Damage to your credit history if defaults are reported to credit bureaus.

You must have a realistic plan to avoid these debt traps associated with payday loans.

Finding a Reputable Lender for a 500 Dollar Payday Loan with All Credit Types Welcome

Numerous cash advance loans or payday loans online with next business day funding exist, both online and at physical locations—such as options found via “online payday loans near me.” However, some providers engage in unsavory practices. Here are signs of reputable lenders:

- Fully licensed in your state, verifying loan eligibility

- Discloses all interest rates and fees upfront without hiding details in the loan agreement

- Does not pressure you to reborrow or take on larger loans

- Allows at least 14 days for the repayment of the initial loan

- Gives you the right to rescind the loan within one business day without fees

- Follows state regulations regarding rollovers and collections

- Conducts soft credit checks, preserving your credit report from being negatively affected

Obtaining a loan—especially quick online payday loan requests—must be a carefully considered decision. You should fully understand the terms and assess your ability to repay.

A $500 loan must be repaid by your next payday. Lenders may offer more flexible repayment terms.

Doing your research helps you avoid predatory lenders who trap consumers in cycles of unaffordable debt. Seek lenders who work within your financial means and offer competitive interest rates and transparent lending terms.

Alternatives to Consider Before Requesting a 500 Dollar Payday Loan

It is tempting to consider bad credit loans advertised with guaranteed approval for amounts of $1,000, $2,000, or even $5,000 if you’re in a financial bind and need money now despite having bad credit. However, be aware that these loans are high-cost and high-risk. So, before resorting to bad credit loans, payday loans with fast funding, or instant payday loans, consider the alternatives:

- Asking your employer for a payroll advance or payday alternative loans

- Borrowing small amounts from trusted friends or family

- Using low-interest credit cards for money advances or to cover medical bills

- Tapping into savings accounts or retirement funds

- Obtaining a traditional loan from a bank or credit union

- Requesting emergency relief funds from charities or nonprofits

- Setting up no-fee payment plans directly with service providers

The options above may require more time and effort, but they can help you avoid the pitfalls associated with high-risk payday loans from direct lenders.

Key Takeaways on 500 Dollar Payday Loans Online with All Credit Types Welcome

- Payday loans provide access to funds quickly but charge high interest rates and fees, making them expensive.

- Bad credit personal loans require ID, income verification, a bank account, and a minimum age, but all credit types are welcome. Fast results for online payday loans may be available.

- You must repay the full loan amount and fees by the due date—typically your next pay date—if you urgently need a payday loan for bad credit. Late payments can result in additional charges.

- Bad credit loans, instant payday loans, or loans with all credit types welcome carry risks such as recurring fees, aggressive collection practices, and bank penalties that can trap borrowers in cycles of debt.

- Exhaust all cheaper alternatives before opting for a payday loan online with funds deposited by the next business day. Use them only as a last resort.

- Finding licensed, reputable lenders who follow all state regulations helps ensure a fair lending experience.

Frequently Asked Questions for 500 Dollar Payday Loans with All Credit Types Welcome

Am I able to get more than $500 for a payday loan?

Other lenders may approve you for amounts over $500 – or even up to $5,000 for bad credit personal loans – after reviewing your regular income, expenses, and repayment capability. These types of loans require meeting basic criteria, and first-time borrowers often have lower limits that can increase over time with on-time repayments.

Repayment terms for payday loans for bad credit—generally the $500 tribal installment loans—are typically 7 to 30 days, with additional state-specific regulations. You owe the full $500 plus all fees and accrued interest on your next pay date as specified in the loan agreement for bad credit payday loans.

Am I able to get a $500 payday loan with bad credit from a lender?

Yes, there is a possibility for payday loans where all credit types are welcome, meaning that a poor credit score may not automatically disqualify you. As long as you meet the lender’s eligibility criteria—such as income, employment, ID, and bank account requirements—these lenders may provide you with a loan when other options are limited. However, please note that approval is not guaranteed and is subject to individual lender review.

What do I need to request a $500 payday loan?

Most providers of quick loans require a government-issued ID, recent pay stubs or bank statements demonstrating income, your Social Security number, physical address, phone number, and active checking account information.

What happens if I default on a $500 payday loan?

If you default on a payday loan, you may face additional fees, persistent collection calls, bank overdraft charges if automatic withdrawals continue, lawsuits, and wage garnishment. Defaulted loans may also be reported to credit bureaus, negatively affecting your credit score.

Where am I able to get a $500 payday loan?

Request a loan online or visit physical locations if you’re looking for $1000 loans with all credit types welcome or lower amounts such as $100 loans online. Request funds online from state-licensed lenders offering transparent rates and terms. Avoid lenders who are evasive about costs and opt for reputable options such as the best online payday loans and payday loans with funds deposited by the next business day for convenience.

The Bottom Line on 500 Dollar Payday Loans for Bad Credit with All Credit Types Welcome

Emergency loans like a $500 payday loan with all credit types welcome may seem like an excellent quick fix when you urgently need funds before payday. Options such as payday loans for bad credit, personal loans, and even online payday loans with funds deposited by the next business day are available. However, the exceptionally high interest rates make this type of loan a very expensive option, often resulting in owing significantly more than the amount borrowed.

Have a solid plan to repay the full balance on time to avoid straining your budget with high payment demands if you use payday loans. Understand the risks, review all alternatives first, and borrow only what you realistically can afford to repay. The implications of rapid online payday loan requests—where approval is not guaranteed—require careful consideration. Even with the allure of credit cards with $1,000 limits for bad credit, promises of a $1000 loan online, or a $100 loan deposited to a prepaid debit card offered by some payday loan apps, exercising caution in your loan choices can help mitigate potential pitfalls.