Online payday loans have increasingly become a go‐to solution for individuals grappling with unexpected expenses between paychecks. These are small, short‐term loans with markedly high interest rates, facilitated by a network of online payday loan providers. Online payday loans for bad credit and online payday loans with no credit checks (all credit types are welcome) are relatively easy to qualify for; however, they carry noteworthy risks if not managed prudently.

The comprehensive guide demystifies how online payday loans function, elucidates the pros and cons of this long‐term financial solution, presents safer alternatives, shares tips for responsible borrowing, and discusses vital factors to understand before starting the loan request process.

Decoding Online Payday Loans for Bad Credit

A payday loan, connected with a participating lender, is a relatively small, short‐term loan intended to help borrowers cover emergency costs until their subsequent paycheck. Upon receiving the paycheck, the loan proceeds must be repaid in full.

Payday loans generally vary from $100 to $1,000, with variations subject to state laws. Payday loan options have annual percentage rates (APRs) surpassing 400% with exorbitantly high fees compared to other types of loans.

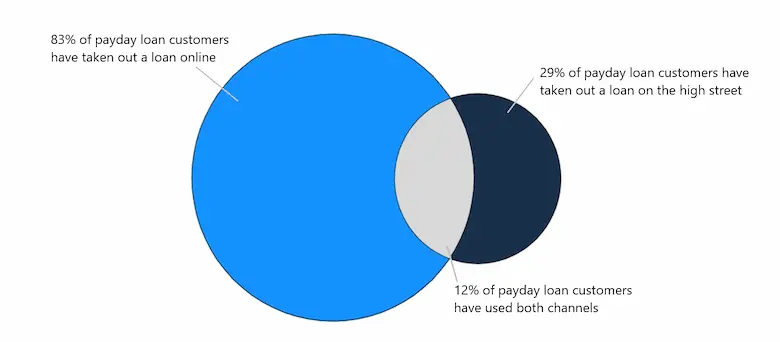

These loans are procured via physical storefront payday lenders or, increasingly, through an extensive network of lenders online. Online payday loans have seen a surge in popularity, particularly due to the added convenience, minimal paperwork, and quick access to funds they provide.

Online payday loan providers enable the entire loan process to occur digitally. Borrowers submit a loan request, and if approved by a participating lender, funds are transferred to their bank account as quickly as one business day following approval. This swift process makes online loans, such as cash advance loans, an attractive option for individuals needing to address emergency expenses or medical expenses between paychecks.

Nevertheless, the convenience and versatility of online payday loans involve significant risks that borrowers must understand carefully before proceeding with a loan request.

How Best Online Payday Loans from Lender Networks Work?

It starts with a loan request, usually online, where applicants with even poor credit scores stand a chance. Small payday loans online no credit check options are available through select participating payday lenders. Post approval of the payday loan request by a participating lender, the loan proceeds are swiftly transferred to the borrower’s bank account. These competitive online payday loans are due for repayment as soon as the borrower receives their next paycheck, along with the accrued interest and fees. It’s a simple and straightforward solution, but managing your bad credit scores and understanding the differences between traditional loans and payday loans significantly affects your financial health.

The loan request process with a reputable payday loan provider is structured to accommodate various credit types. Note that bad credit loans are facilitated by short‐term lenders for a variety of loan purposes. Here’s a breakdown of the flow:

Step 1: Initial Loan Request

- The borrower submits a loan request form online, indicating their preferred loan amount ($100, $500 & $1000). The procedure employs an online form, which simplifies the process. – Applicants are expected to disclose personal data comprising identification, contact information, employer details, income figures, and active checking account details.

Step 2: See Your Loan Options Quickly

- Online lending businesses use the information entered in the loan request to estimate the borrower’s credibility quickly, catering to people seeking quick payday loans or aiming to reduce the emergency loan impact. – A quick decision about payday loans is provided within minutes based on eligibility criteria. Exact requirements differ from one lender to another.

Step 3: Review Loan Agreement

- The borrower receives a full loan contract outlining the loan amount, applicable charges, repayment due date, the borrower’s next pay date, the complete repayment schedule, and penalties for non‐payment. – The quick loan review process is designed to provide transparent financial details, including the impact of various credit types on rates.

Step 4: Sign Agreement & Accept Funds

- The borrower must digitally sign the loan contract to complete the process. – Subsequently, a participating lender deposits the approved loan amount directly into the linked bank account by the next business day.

Step 5: Repayment

- The borrower must repay the full loan amount, inclusive of any fees, by the scheduled due date—typically the next paycheck. Loan repayments are automatically withdrawn from the borrower’s account on the agreed repayment date. – Most providers offer the flexibility to make payments over time, helping to mitigate the emergency loan impact.

Be conscious of making responsible financial decisions, as this streamlined process includes online payday loans with funds typically transferred by the next business day, and supports individuals seeking fast funds. Irresponsible borrowing can lead to daunting debt cycles, so prudence is essential.

Payday loans can provide a rapid solution to unexpected financial needs. However, they carry substantial fees and high‐interest rates, which can make them costly if not repaid as agreed upon by both parties. On average, payday loan users spend $520 in fees to borrow $375, according to Balancing Everything.

| Scenario | Value |

|---|---|

| Traditional payday loans: Average fees paid to borrow are $375 | $520 |

| Approval rate: Odds of payday loan usage | 62% higher for those earning less than $40,000 annually |

| The age group most likely to use instant approval payday loans (approval not guaranteed) | 25-49 |

| Maximum APR interest on a $300 payday loan in the US | 664% |

| Average payday loan default rate | 6% |

| Typical credit card default rate | 6% |

What Are the Potential Pros of Online Payday Loans with Guaranteed Approval? (Approval Not Guaranteed)

Payday loans online, including $255 payday loans online, can yield advantages when used responsibly:

Quick access to funds

These payday advances operate through an online system that offers quick decisions on instant payday loans with guaranteed approval (note: approval is not guaranteed), often involving a credit check loan process.

The emergency loans loan request and review process, which offers a quick solution for emergency financial needs, can be completed in just minutes, with funds typically deposited by the next business day after approval, making payday loans platforms particularly helpful for covering sudden costs like medical bills or car repairs, and adding a sense of urgency for people facing a financial emergency.

High approval chances for bad credit borrowers

Payday lenders generally require only proof of income, a regular flow of money, and a personal checking account. In fact, even people with bad credit or limited credit histories may qualify, providing access for borrowers who struggle to get approved elsewhere, and connecting them with a reliable payday loan provider that offers various types of loans, including bad credit personal loans and title loans.

Convenient online process

The loan request process is completed online via your phone, tablet, or computer, allowing potential borrowers to access funds from anywhere without extensive paperwork or in‐person appointments. It’s ideal for people who need quick access to funds and desire a more streamlined process.

Straightforward services and terms

The loan details, including fees, timeline, and repayment process, are spelled out clearly in your payday cash advance loan agreement, which provides straightforward services with no surprises or complex terms, enabling potential borrowers to make an informed decision about payday loans.

No collateral required

Payday loans are unsecured, so borrowers do not have to provide collateral like a house or car to get approved; this sets them apart from other loan types, such as title loans, where you risk losing property if you default. They are intended as a temporary solution with lower risk compared to secured loans, particularly for people needing prompt financial assistance.

Spanning across the United States, PaydayDaze is proud to provide accessible and convenient online payday loan services by connecting borrowers with participating lenders in several states. Below, you’ll find a comprehensive list of the American states where we are actively helping individuals bridge their financial gaps with our trustworthy and transparent payday loan solutions. We’re committed to offering responsible loan options to those in need, ensuring that our services are available to individuals seeking reliable financial support.

| Alabama / AL | Alaska / AK | Arizona / AZ | Arkansas / AR |

| California / CA | Colorado / CO | Connecticut / CT | Delaware / DE |

| District Of Columbia / DC | Florida / FL | Georgia / GA | Hawaii / HI |

| Idaho / ID | Illinois / IL | Indiana / IN | Iowa / IA |

| Kansas / KS | Kentucky / KY | Louisiana / LA | Maine / ME |

| Maryland / MD | Massachusetts / MA | Michigan / MI | Minnesota / MN |

| Mississippi / MS | Missouri / MO | Montana / MT | Nebraska / NE |

| Nevada / NV | New Hampshire / NH | New Jersey / NJ | New Mexico / NM |

| New York / NY | North Carolina / NC | North Dakota / ND | Ohio / OH |

| Oklahoma / OK | Oregon / OR | Pennsylvania / PA | Rhode Island / RI |

| South Carolina / SC | South Dakota / SD | Tennessee / TN | Texas / TX |

| Utah / UT | Vermont / VT | Virginia / VA | Washington / WA |

| West Virginia / WV | Wisconsin / WI | Wyoming / WY |

An online payday loan is best used prudently as a last resort for small, urgent borrowing needs and provides quick access to funds for people with few other alternatives.

What Are the Potential Cons of $255 Payday Loans Online?

Online payday loans do offer advantages, but there are drawbacks and risks to look at:

Very high interest rates

Payday loans have higher interest and fees than consumer loan products, such as bad credit personal loans. Average annual percentage rates for payday loans exceed 400%. Others are over 600% or even 1,000% APR.

Short-term loans with short repayment terms

Most payday loans, which are short-term loans, must be repaid in full within 14–30 days. Trying to repay the full balance and very high fees in such a short timeline is challenging for struggling borrowers.

Risk of overdraft fees due to lack of steady source of income

Dealing with Overdrafts Linked to Checking Account

In instances where automatic repayment withdrawals cause an overdraft in the linked valid checking or bank checking account, the borrower incurs costly overdraft fees on top of standard loan rates, which happen with a regular payday loan or even when seeking to borrow money online.

The Danger of Falling into Debt Traps

Reliable payday loan providers offer short‐term, easy‐to‐access loan options. The terms and the rapid access to funds can unintentionally make it easy for borrowers to fall into a cycle of continuously taking new loans to clear old ones, potentially deepening their debt through a succession of quick loans.

Consequences of Late or Non-Payment

Failing to repay payday advance loans on time leads to aggressive late payment penalties from the lender, potentially aggravating the borrower’s financial condition. Not to mention, the late payment fees discourage making payments on time.

Payday Loans: Not Ideal for Credit Building

Even though payday lenders report to credit bureaus, their high‐interest rates and short‐term periods make them less than ideal for establishing long‐term credit. They are popular in the online lending market, but their emergency loan approval rate isn’t worth the cost.

Despite offering immediate access to funds, payday loans can result in significant long‐term expenses if not used wisely as a short‐term solution during financial emergencies. The likelihood of entering an expensive debt cycle is relatively high when resorting to this type of loan.

What Are Smarter Alternatives to Small Payday Loans for All Credit Types?

People dealing with cash flow difficulties and in need of emergency funds have safer financing options than payday loans, including options with flexible repayment options for loans for people in various financial situations:

Borrowing from Family or Friends

For people with friends or family members who lend money, an informal loan with flexible terms from a loved one helps cover immediate costs without excessive fees. Even modest interest rates are much lower than payday loans.

Low-Rate Credit Cards

Even while bearing interest, credit card APRs are generally far lower than payday loans. Balance transfer credit cards offer 0% introductory periods, allowing for interest-free financing for a limited time.

Traditional Personal Loans

Obtaining an installment loan through a bank, a credit union, or an online lending platform offers a reasonably priced loan with much lower interest rates, longer terms, and manageable monthly payments. These are great alternatives to payday loans.

Employer Advances

Engaging with reputable lenders in the online lending market may offer a high chance of approval (approval not guaranteed) even for borrowers with bad credit or where all credit types are welcome, creating a more viable option than the traditional payday loan trap. Such an advance covers urgent costs without subjecting the user to excessively high fees, thereby avoiding destructive debt cycles.

Employers and companies offer advances, a type of emergency loan, to employees undergoing temporary financial hardship. These aren’t traditional payday loans; employees repay them through direct payroll deductions, usually with no origination fees, akin to a very flexible loan with minimal conditions.

Payment plan with creditors

One suitable approach for people wary of the minimum credit score requirement of standard loans is to contact utility providers, medical facilities, or other creditors directly. Arranging an equitable, no‐fee extended repayment plan can help avoid late fees and ensure continued service, making timely repayments more manageable and serving as a cost‐effective alternative to payday loans.

Local non-profit assistance programs

Another alternative is local community organizations such as churches, food banks, and United Way. Such institutions offer types of emergency loans and grant programs free of cost. One needs only to meet the minimum requirements, and the painless lending process readily offers help if funds are available.

Special lines of credit

For people with decent credit records, taking credit card advances, opening retail credit cards, or securing overdraft lines of credit are less expensive crisis financing options. They frequently offer competitive rates over the maximum loan term, unlike the more rigid payday loans.

Evaluating all available solutions before resorting to expensive online payday loans can guide borrowers toward the most reasonably priced alternative to manage their temporary fiscal deficits.

Tips for Safe and Responsible Online Payday Loan Borrowing

For people who conclude that an online payday loan is the optimal emergency recourse after evaluating other alternatives, bearing the following tips can help mitigate potential risks:

- Borrow only what you realistically can repay on your next paycheck while continuing to cover essential expenses. Avoid being tempted by the offered maximum loan term. – Be prepared with a viable repayment strategy to fully cover the loan balance and any fees by the due date, which helps avoid reliance on flexible lenders, loan renewals, and debt cycles. – Review your budget thoroughly to identify non‐essential costs that can be reduced or eliminated, allowing more funds to be allocated toward prompt loan repayment. Treat it as an emergency. – Fill out the loan request in minutes using a valid email address on a secure online loan marketplace with advanced encryption technology, which typically provides a quick decision. Be sure to select the correct loan type. – Remain vigilant against scams by double‐checking the platform and any lender partnerships. Report any suspicious activity immediately via the provided email address.

- Being proactive is key. Don’t hesitate to contact your lender if you anticipate being unable to secure a regular income and have trouble making the full payment on time. Ask about any grace period or hardship options. Many work with unemployed people or people who reach out early to avoid default.

- Avoid taking multiple payday loans from diverse lenders simultaneously, as this compounds debt and makes it exceedingly difficult for individuals to manage payments, especially when dealing with payments to credit agencies.

- It’s essential to read loan terms, fees, and policies thoroughly before signing anything. Protect your financial details by fully comprehending the agreement before you electronically sign.

- Set up automatic withdrawals or manual calendar reminders for the repayment date to avoid late payments and penalties. This is particularly important for permanent residents with an extensive network of financial commitments.

- Start building an emergency fund, even with small amounts, to help avoid reliance on payday loans for unexpected expenses—a piece of advice well worth taking from a financial advisor.

Payday loan borrowers can better manage interest costs and avoid harmful debt cycles by establishing a repayment plan and reaching out early if difficulties arise, which is particularly beneficial for those with a minimum income.

Frequently Asked Questions About Online Payday Loans for Bad Credit

What interest rates do online payday lenders charge?

Payday loan interest rates are a prickly subject. They range from 200% to over 600% APR online. State laws cap APRs in most areas, while in others, there are no limits for legal residents. Rates depend on the lender, loan amount, and the loan term length.

When do I have to repay an online payday loan?

Most online payday loans must be repaid in full on your next pay date in around 2–4 weeks. These flexible loans sometimes allow longer 30–60 day terms, with your specific due date detailed in the loan agreement. Employment details and monthly income also play a significant role.

Am I able to get a payday loan online quickly?

Many online lenders advertise rapid deposit payday loans, but receiving funds on the day you apply is uncommon. Other lenders offer very fast emergency loan approval; however, most deposits require at least one business day.

What if I can’t repay my online payday loan on time?

Contact your lender or a customer service representative immediately to discuss your options if you anticipate missing your payment due date. You may also avail yourself of credit counseling services. Extensions or higher late fees might be incurred, and many lenders provide a payment plan to avoid default, which is especially important for borrowers with an active bank account and a steady income.

As a borrower, do I qualify for a payday loan even with a poor credit score?

Online payday loan operators provide a range of loans for borrowers with poor credit scores. They aim to offer a quick experience and serve as a reliable source of funds to help meet emergency spending needs. Loan options can be very rapid, depending on your individual circumstances.

Is taking an Online Payday Loan a good thing to Address My Credit Card Debts?

Payday loans, including no credit check payday loans with guaranteed approval and bad credit loans with guaranteed approval (note: approval is not guaranteed), serve as a tool to bridge the income gap and address credit card debts. Timely repayments can help build credit; however, the high interest rates may make other alternatives, such as secured cards or auto loans, more favorable.

Key Insights into Online Payday Loans and Debit Cards

- Payday loans, including options for rapid decisions and available to all credit types, offer quick access to emergency funds for borrowers with bad or no credit. They typically feature high-interest rates and short repayment terms.

- It’s worth exploring all other low-cost borrowing options before applying for payday loans for bad credit, such as larger network services or tribal loans. You must have a viable plan to repay the entire amount in time.

- You should never borrow more than you can comfortably repay with your next paycheck while covering basic expenses. Avoid falling into a cycle of recurring borrowing.

- Read all loan terms carefully and contact your lender early if you anticipate difficulties meeting the repayment date. Setting up reminders can help avoid incurring penalties due to missed payments.

- Continuously work on improving your savings and credit to unlock more affordable emergency medical borrowing options, such as installment loans and soft credit check loans, for future needs.

To summarize, online payday loans, including fast payday loans, cater to specific short‐term borrowing needs. However, borrowers must exercise due caution and financial discipline. Using these loans as a last resort while concurrently working to improve your financial health can help minimize risks and prevent debt accumulation. The process is designed to enhance the experience for applicants in urgent situations. Consider options such as no denial payday loans or those offered exclusively through direct lender connections (note: approval is not guaranteed), which may feature low interest rates. Additionally, even $100 loans online are available for small‐dollar borrowing needs.