Many people are struggling with credit card debt today. The debt burden is overwhelming and stressful due to unexpected expenses, poor financial management, or unforeseen emergencies. Individuals assess borrowing money to pay off their existing debts. It is necessary for individuals to carefully assess the implications and potential consequences of such an action while it seems like a viable option to alleviate immediate financial strain. Making wise financial decisions is crucial to overcoming debt.

Understanding Your Debt

Imagine being buried under a mountain of bills, each representing the amount you owe various creditors. The weight of your debt is suffocating, leaving you feeling trapped and helpless. There are options available that help lift the burden off your shoulders. Debt management plans, debt consolidation loans, and credit counseling are all viable solutions to manage your outstanding balances. Researching and selecting the best debt relief company to assist you in your journey toward financial freedom is important.

Regain control over your finances by consolidating your debts into one loan or seeking advice from a credit counselor. It’s necessary to assess interest rates and how they affect your ability to pay back what you owe while taking steps to improve your credit score to secure better terms for future loans. Applying a financial strategy and comparing debt consolidation loan offers can help you find the best solution.

Different Types Of Loans

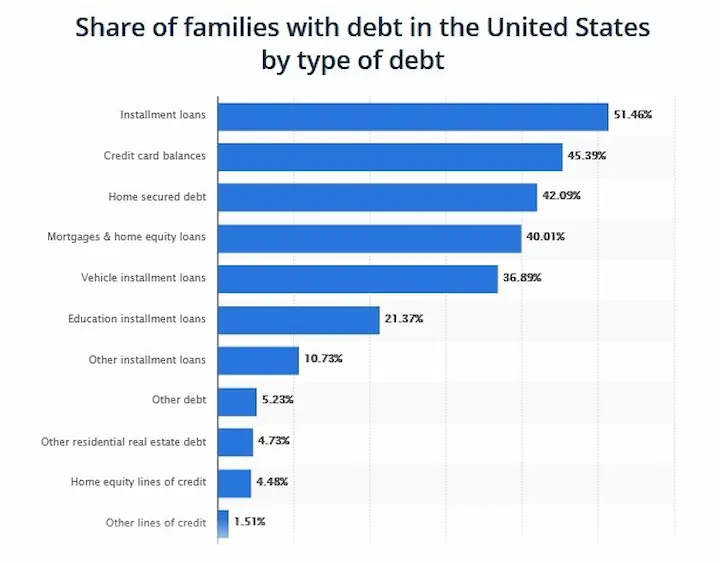

The various types of loans available for individuals, businesses, and students include Personal Loans, Home Loans, Business Loans, Student Loans, Auto Loans, Payday Loans, Credit Card Loans, Unsecured Loans, Secured Loans, Line of Credit Loans, Bad Credit Loans, Short-term Loans, Micro-loans, Merchant Cash Advances, and Peer-to-Peer Loans. Each type of loan has advantages and disadvantages that must be assessed before making a decision, considering factors like repayment period and interest rates.

Personal Loans

Personal loans are unsecured loans offered by financial institutions for any purpose. They commonly have fixed interest rates and repayment terms, making them popular for consolidating high-interest credit card debt or cover unexpected expenses. A personal loan lender might offer competitive personal loan rates compared to other options, such as credit cards.

Approval for a personal loan depends on factors such as your credit score, income, and existing debts. Shopping around for the best loan terms and assessing if taking on more debt is the right decision for your financial situation is necessary. A debt consolidation method like a personal loan can help streamline your finances and prevent mounting interest charges.

Home Loans

A home loan is a secured loan used to purchase or refinance a property. Home loans commonly have longer repayment terms and lower interest rates than personal loans, but approval depends heavily on factors such as credit scores, income, and debt-to-income ratio.

Loan terms vary widely depending on the type of home loan, with fixed-rate mortgages being popular for their consistent monthly payments over the life of the loan. It is necessary to assess your financial situation carefully before taking on a long-term commitment, as with any loan decision.

Pros Of Borrowing Money: Access To Funds

Borrowing money offers access to funds unavailable through other saving strategies or budgeting tips when dealing with debt. The process is particularly true for individuals facing high-interest rates or severe financial situations needing immediate relief.

Borrowers gain the flexibility to pay off existing debts while having breathing room in their monthly cash flow by getting a loan. Access to more funds helps individuals stay on top of payments and avoid falling further behind on their bills, like making their minimum payment on credit card balances. Careful deliberations must be given when deciding to borrow money, as the decision-making process has pros and cons.

Low-Interest Rates

One of the primary benefits of borrowing money is enjoying low-interest rates, which lead to lower loan payments and overall borrowing costs. This advantage, in turn, allows borrowers to allocate a more significant portion of their monthly income toward essential expenses and other financial goals.

One factor in assessing when deciding if to borrow money is the interest rate on the loan. Low-interest rates make borrowing an attractive option for individuals looking to consolidate debt or finance large purchases. Borrowers secure loans with lower interest rates, saving them money in the long run with good credit scores. Options like an equity loan or various personal loan options can offer lower rates, especially for those with an excellent credit score.

Debt consolidation through a low-interest-rate loan simplifies monthly payments and improves overall financial management. It’s necessary to carefully review all terms and conditions of any loan agreement and guarantee that taking on more debt is necessary before making the decision. Consider aspects such as the personal loan payment schedule and any penalties for early repayment.

Choosing The Right Loan For You

Borrowing money is a helpful solution for borrowers who need it when managing debt. Choosing the right loan is daunting, especially assessing the various available options. Making an informed decision is necessary to guarantee that the chosen loan meets one’s financial needs and is manageable to repay. Considering whether an equity loan may suit your needs or exploring other personal loan options is essential in decision-making.

Listed below are the steps to choosing the right loan for you.

- Evaluate the Pros and Cons of Borrowing Money

Assess if borrowing is the best option for your financial situation before applying for a loan. It’s necessary to weigh the pros and cons of using savings versus getting a loan to pay off debt, such as credit card bills. - Assess Loan Eligibility Requirements

Different types of loans have different eligibility requirements, such as minimum credit scores and income levels. Reviewing the process requirements beforehand helps you determine which loans you qualify for and prevent unnecessary credit inquiries that negatively impact your credit score. - Research Different Loan Types and Lenders

Online lenders and credit unions must carefully examine each lender’s varying terms and conditions before committing to any agreement to research various types of loans available from traditional banks for paying off credit card bills. - Compare Interest Rates and Fees

Comparing interest rates and fees from different lenders help you save money over time, especially when dealing with credit card bills. Be sure to understand the annual percentage rate (APR) and other charges associated with the loan. - Create a Repayment Plan

Create a repayment plan that includes manageable monthly payments before committing to a loan. Prioritizing high-interest debts first, like credit card bills, and implementing smart spending habits in the future help reduce the overall debt burden and build good credit.

Evaluating Your Finances

Evaluating your finances before assessing borrowing money is necessary if you are in the situation. One key aspect of financial planning is budgeting strategies. Creating and sticking to a budget help you better manage your money and prioritize paying off debts.

Debt consolidation is an option for borrowers struggling with multiple sources of debt. The process involves combining all debts into one payment with a lower interest rate. Assessing the impact on credit scores when pursuing the route is necessary. A personal debt consolidation loan is an option for you to consider.

When dealing with unsecured debts, it might be worth considering the help of a debt settlement company. However, weighing the pros and cons before deciding on this route is essential. Also, be aware of any balance transfer fee when consolidating debts through a balance transfer.

Sometimes, opting for a loan for credit card debt is a suitable option. But remember that a financial institution may charge an interest rate on the borrowed amount.

Short-term loans are another option you must only use as a last resort due to high-interest rates.

In overview, evaluating your finances and exploring various options, such as budgeting strategies and potential consolidation plans, lead to improved financial stability and reduced debt burdens.

Deciding If Borrowing Is Right For You

Evaluating if the decision aligns with your overall financial goals is necessary when assessing borrowing money to pay off debt. Building credit and maintaining a healthy budget are necessary for long-term financial planning. Researching and comparing different options, such as credit card payments, lines of credit, and managing current debts is necessary to guarantee the best feasible terms and interest rates. Loan consolidation is worth exploring as it simplifies payments, like credit card payments, and lowers interest rates.

It’s necessary to recall that borrowing must only happen after carefully assessing all other available strategies for managing debt, such as adjusting spending habits or seeking professional advice on budgeting basics.

Determining to borrow requires a thorough understanding of your financial situation and goals.

Payday Loan Fees and APRs

Payday loans are an expensive way to borrow money, with high fees and annual percentage rates (APRs) that reach as much as 400% or more. The table below compares the fees and APRs for different payday loan amounts and loan terms, according to paydayloaninfo.org. They are often used when people need extra money for a short period of time.

| Loan Amount | Finance Charge | Total Repayment | APR |

|---|---|---|---|

| $100 | $15 | $115 | 391% |

| $100 | $30 | $130 | 782% |

| $500 | $75 | $575 | 391% |

| $500 | $150 | $650 | 782% |

| $1,000 | $150 | $1,150 | 391% |

| $1,000 | $300 | $1,300 | 782% |

It’s essential to understand the total cost of borrowing, including the monthly loan calculator results and monthly loan payment, for the chosen period of time before opting for a payday loan. It will make it easier to determine if this option is the most suitable one for your financial situation.

Payday Loan Fees and APRs

The table shows the fees and APRs for different payday loan amounts and terms. For example, if a borrower takes out a $100 payday loan for a two-week term, the finance charge is $15, resulting in a total repayment of $115 and an APR of 391%. You can compare this to a credit card company or credit card issuer, which typically has lower APRs and offer more flexible repayment options.

The total repayment is $130 if the finance charge were $30 instead, and the APR is 782%. Similarly, a borrower who takes out a $500 or $1,000 payday loan pays either $75 or $150 in finance charges for a two-week term, resulting in APRs of 391% or 782%, respectively. The high fees and APRs quickly add up, making it challenging for borrowers to manage their loan balances. Borrowers must consider options such as negotiating late payment fees or finding extra income sources to manage their debt more effectively.

The Bottom Line

Borrowing money to pay off debt is a decision that requires careful deliberation. Understanding your current financial situation and the different types of loans available help you make an informed choice. Getting a loan relieves overwhelming debt, but it has risks, such as high-interest rates and potential damage to your credit score.

Evaluating your finances before deciding if borrowing is the right option for you is necessary. Some common types of loans include paying off medical bills, securing a mortgage loan for your home, consolidating debts into a single loan, utilizing personal loan funds for miscellaneous expenses, and managing student loan debt.

Imagine getting a loan to put a fire in your home as an anecdote. The cost and impact on your financial health are significant. Borrowing money must only be seen as a quick-fix solution to assess the long-term consequences while it solves the immediate problem.

Frequently Asked Questions

Is borrowing money to pay off debt a wise financial strategy?

It depends on the interest rate savings and repayment terms. Consolidating high-rate debts like credit cards into a lower fixed-rate installment loan can save substantially on interest.

What are the pros and cons of using a personal loan to pay down debt?

Pros are fixed payments, predictable interest costs, and simplified finances. Cons are fees, longer repayment terms, and risk of overborrowing. Assess if savings outweigh costs.

Are there specific types of loans or credit options that are better for debt consolidation?

Balance transfer credit cards and personal loans tend to offer the lowest rates for consolidation. Home equity loans also allow tax-deductible interest but risk your home.

How can I determine if borrowing money to pay my debt is the right choice for my financial situation?

Calculate potential interest/fee savings against the costs of a new loan and ensure the monthly payment fits your budget. Also, consider your credit, job security, and financial discipline.

What alternatives should I consider before deciding to borrow money to address my debt?

Alternatives like balance transfers, credit counseling, debt management plans, budgeting, selling assets, or negotiating current debt payments yourself.