A good credit score is necessary to receive loans and other financial assistance. But what happens when an individual has a lower-than-average credit score? PaydayDaze discusses the chances of obtaining a loan with a credit score of 640, which is generally considered below average or even bad. It addresses several factors that affect one’s ability to obtain approval for such a loan and provides useful advice on increasing the chances of getting approved.

Borrowers must be aware of the importance of having access to loans in today’s world. Modern economies lead to increased reliance on financing from banks and lending institutions. Lenders look at an individual’s credit history before approving them for any loan. It becomes necessary for individuals with low scores to understand their options and take steps toward improving their situation.

Overview Of Credit Scores

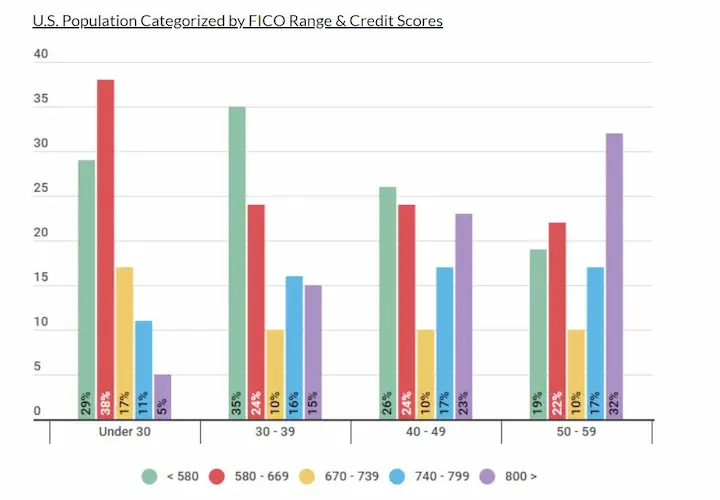

Credit scores are a numerical expression of an individual’s creditworthiness. They reflect the information on a person’s credit report and range from 300 to 850, with higher numbers usually indicating better-borrowing potential. Financial institutions use credit scores to determine if to approve applications for loans, lines of credit, mortgages, and other types of financing.

A good credit score is above 700, while lenders see anything below 640 as subprime. According to Upstart, the typical borrower with prime credit (720 or higher FICO score) got an APR of 5.34%. The table below contains the breakdown.

| Credit Score Range | Average APR on a 60-month new auto loan |

|---|---|

| 720 or higher | 5.34% |

| 620-659 | 11.76% |

| 590-619 | 15.92% |

Obtaining approval for loans or other forms of financing is challenging for many people with lower-than-average credit scores. A low credit score does not necessarily mean getting loan approval is impossible. There are still options available for people with less-than-perfect credit histories, such as secured loans, peer-to-peer lending platforms, and even payday lenders, which offer short-term solutions in emergencies.

Elements That Make Up Your Credit Score

Several vital elements come into play when understanding your credit score. They include payment history, the amount of debt you have incurred, and how long you have managed your debts effectively. Your payment history is necessary to determine your score, as timely payments over an extended period are evidence of responsible borrowing behavior.

The amount of debt you owe relative to available credit limits affects your rating. The length of time for which you have managed existing debts successfully is another key variable. Lenders see it as an indication of how well someone handles their financial obligations.

Paying any outstanding debts must be a priority, first and foremost, regarding improving one’s rating. It involves consolidating existing loans or lines of credit with better repayment plans so that payments become more manageable every month. Keeping up with regular payments without fail helps to achieve a positive track record over time while limiting new applications for extra credit until needed assists in providing stability to scores.

Restoring good credit takes patience and discipline. Taking small steps towards reducing debt and establishing a reliable pattern when making monthly repayments proves immensely beneficial in helping rebuild any damaged ratings due to past mistakes.

Eligibility Criteria For Loans

Different lenders have varying requirements when assessing potential borrowers and their ability to take on new debt responsibly. A good credit score opens up access to various loan options, though you must understand the eligibility criteria for such loans. A score between 640-680 is still under the category of ‘good’ in a few instances. It depends on other factors such as income level and how much existing debt one holds already.

Certain lenders specialize in providing personal loans tailored to individuals with lower scores. They are commonly known as subprime or bad credit lenders. They have higher interest rates than standard products from banks or non-specialized providers. Still, they provide an avenue for people who need access to traditional financing methods due to limited credit history or past mistakes.

Shop around and compare offers for the most favorable terms. You must not overextend yourself financially beyond what you are able to manage each month comfortably. Focus on gradually rebuilding your credit rating by making timely payments and cutting down unnecessary expenses where necessary.

Impact Of Credit Score On Loan Interest Rates

Your credit score directly impacts the interest rate offered when applying for a loan. Generally speaking, people with higher scores are likely to obtain lower rates as it demonstrates their financial responsibility and capacity to manage debt accountable. In contrast, individuals with poorer ratings pay more due to increased perceived risk by lenders.

You must review other factors, such as how much money one wishes to borrow and the period before committing to any agreement. Doing so enables you to compare offers accurately from different providers and get the most suitable product, given your current situation.

Take extra care not to fall into a cycle of bad debts if you go the subprime route. Focus on making payments regularly and look for ways to generate extra savings or income to increase repayment amounts further. Doing so enables you to improve your financial health while reducing future borrowing costs.

Finding The Right Lender For Low Credit Scores

Several options are available for finding the right lender for a loan with a credit score 640. First and foremost, individuals must review government-backed programs like those mentioned above. They offer more lenient terms than traditional lenders due to their public nature. Various states have specific loan programs tailored towards people with lower scores, potentially providing better rates or extra benefits not found elsewhere.

People not qualifying for the abovementioned assistance schemes have plenty of private organizations worth reviewing. Many banks and other financial institutions now offer loans specifically designed for people with bad credit histories. Still, they generally come at higher interest rates or fees than standard products.

It is easy to find smaller lenders ready to take on greater risk by offering favorable terms despite one’s past mistakes. Applicants must do their due diligence in researching potential providers beforehand to choose one which is both reputable and trustworthy.

Navigating the world of loans with a credit score of 640 or lower can be challenging, but PaydayDaze is here to help. Our commitment to accessibility extends across several American states, providing opportunities for individuals with varying credit profiles to secure the financial assistance they need. Below, you’ll find a comprehensive list of the states where our services are available, opening doors for borrowers looking to explore their loan options.

| AL (Alabama) | AK (Alaska) | AZ (Arizona) |

| AR (Arkansas) | CA (California) | CO (Colorado) |

| CT (Connecticut) | DE (Delaware) | DC (District Of Columbia) |

| FL (Florida) | GA (Georgia) | HI (Hawaii) |

| ID (Idaho) | IL (Illinois) | IN (Indiana) |

| IA (Iowa) | KS (Kansas) | KY (Kentucky) |

| LA (Louisiana) | ME (Maine) | MD (Maryland) |

| MA (Massachusetts) | MI (Michigan) | MN (Minnesota) |

| MS (Mississippi) | MO (Missouri) | MT (Montana) |

| NE (Nebraska) | NV (Nevada) | NH (New Hampshire) |

| NJ (New Jersey) | NM (New Mexico) | NY (New York) |

| NC (North Carolina) | ND (North Dakota) | OH (Ohio) |

| OK (Oklahoma) | OR (Oregon) | PA (Pennsylvania) |

| RI (Rhode Island) | SC (South Carolina) | SD (South Dakota) |

| TN (Tennessee) | TX (Texas) | UT (Utah) |

| VT (Vermont) | VA (Virginia) | WA (Washington) |

| WV (West Virginia) | WI (Wisconsin) | WY (Wyoming) |

Sources Of Unsecured And Secured Loans With Low Credit Scores

Two main sources of finance are available for obtaining a loan with a low credit score, unsecured and secured. Lenders assess an applicant’s creditworthiness primarily on their income and expenditure history. Generally, people with higher scores access better terms than individuals with lower ratings. Secured loans require a form of security or guarantee to obtain approval. Unsecured loans involve no collateral. It includes items like property or other assets the lender uses if the borrowers do not repay.

The type of loan suitable for any given individual depends on their circumstances. Many lenders advertise tailored products designed for people needing better credit histories. It is worth reviewing specialist organizations that offer services to people whose financial situations make them ineligible for more traditional borrowing routes. Such companies provide short-term solutions at relatively high-interest rates but remain viable options.

Family members or friends are sometimes open to offering lines of credit. Borrowers must take caution when entering into such arrangements to maintain relationships due to mismanaged expectations surrounding repayment timescales and amounts owed. It pays to shop around thoroughly before making any commitments regarding a specific form of borrowing to determine which option best suits one’s needs and financial capabilities.

Prequalification Process To Obtain A Loan With a Low Credit Score

People with low credit scores find obtaining a loan more challenging than someone with an excellent credit history. You must understand the prequalification process that lenders usually require before applying for any loan agreement to assess risk levels and determine if to grant funding.

- First, potential borrowers must see what kind of loans suit their circumstances, such as secured or unsecured ones. Reviewing factors like current income, assets owned, and liabilities owed helps narrow down choices.

- The next step is to look at various options within each category based on the size of the loan, repayment duration, the interest rate offered, and other terms attached.

- Lenders have different requirements when assessing applications from people with lower credit scores. Meeting such criteria does not guarantee approval, but it increases chances substantially compared to if no preparation had occurred before submission. Many lenders require applicants to complete an online questionnaire that covers financial background topics and the ability to make repayments over time without defaulting. However, preparing beforehand with all necessary documents (such as proof of address) significantly speeds up the process.

Benefits And Risks Of Taking Out A Personal Loan

People with a credit score of 640 or below must know that obtaining a personal loan offers benefits but comes with certain risks. They must weigh the pros and cons carefully before making financial decisions that have long-term implications for future financial stability.

One major benefit of obtaining a loan from an established lender is that it helps rebuild one’s damaged credit score if one makes payments on schedule without defaulting. It not only improves the chances of future financing offered at more attractive rates but signifies responsibility in managing finances responsibly, which all lenders appreciate when assessing potential borrowers.

You must verify that repayment plans fit within budgeted limits so that it doesn’t become unmanageable later. There are downsides, such as high-interest charges with low credit scores and extra fees attached to late repayments. Failure to make regular payments on time results in legal action taken by creditors which causes further damage to one’s reputation, both personally and professionally.

It is advisable to research various offers available widely before committing to any agreement. Read through terms & conditions thoroughly, compare different lenders side-by-side, and seek independent advice to find appropriate funding solutions based on individual circumstances.

Strategies To Improve Your Chances Of Getting Approved For A Loan

Borrowers must understand the factors lenders review when deciding before applying for a loan. Such criteria are dependent on credit score and financial history. There are strategies that borrowers employ to improve one’s chances of getting approved for financing.

- The first step towards obtaining a loan is ensuring that all personal information such as name, address, and Social Security number provided is accurate. It helps potential lenders to have an up-to-date picture of the applicant’s finances.

- Applicants must check their credit report for any errors or discrepancies to correct them before submitting applications.

- Paying off outstanding debts before seeking finance boosts one’s ratings with creditors, indicating a willingness to take responsibility for past obligations.

People looking into borrowing money must know the importance of budgeting properly regarding understanding how much they can afford to repay each month realistically and sticking with it during subsequent payments. Taking such steps beforehand allows individuals to stand a better chance of getting approval, and if successful, they secure more favorable repayment terms too.

Tips To Increase Your Chances Of Acquiring Funds From Lenders

They employ several strategies to increase their chances of acquiring the funds they need from lenders once an applicant is confident that their personal information and credit score are accurate. One option is to provide extra security for any loan or line of credit requested by submitting collateral such as property titles or other assets. It demonstrates to creditors that applicants have something at stake if they fail to meet repayment agreements, showing them that individuals are willing to put up more than just their word to secure financing.

Another tactic that improves one’s chance of acceptance is requesting only the amount needed rather than asking for extra capital. Lenders see that a borrower knows exactly how much money they require. It suggests a certain level of financial responsibility and provides reassurance regarding their commitment to repaying the sum borrowed. People applying for finance must explore the thought of a cosigner ready to repay the debt if necessary. It increases an individual’s likelihood of success when seeking funding.

Conclusion

A credit score 640 is not ideal for obtaining a loan, but it does not necessarily mean you cannot get one. Borrowers must understand the elements that make up their credit score and how they impact their eligibility criteria and interest rates when applying for a loan. Knowing the advantages and disadvantages associated with secured and unsecured loans helps ease the financial burden in the long run.

Various strategies are available to improve your chances of getting approved for a loan and tips on increasing success from lenders. Having a low credit score is difficult to overcome, but by reviewing the above steps, you increase your probability of receiving approval for financing.

Frequently Asked Questions

Is it possible to qualify for a mortgage with a credit score of 640?

Yes, it is possible to qualify for an FHA mortgage with a minimum credit score of 640, but you may get higher rates or fees compared to those with scores above 700.

What types of loans can I get with a credit score of 640?

A credit score of 640 may qualify you for an FHA mortgage, USDA home loan, or subprime auto loan, but interest rates will be higher than with a 700+ score. Personal loans are unlikely.

How can I improve my chances of getting a personal loan with a 640 credit score?

Your chances may improve by providing collateral like a vehicle, showing steady income, having low debt-to-income ratio, minimizing credit inquiries, and applying with a co-signer.

What interest rates can I expect with a credit score of 640 when applying for an auto loan?

With a 640 credit score, expect to pay higher interest rates from 10-20% for an auto loan, compared to 3-5% for those with scores above 720.