The proliferation of payday loans is a cause for concern among policymakers, industry observers, and consumer advocates alike. Critics argue that such short-term, high-interest loans trap low-income borrowers in a cycle of debt that is difficult to escape.

One way that lenders attempt to minimize their risk is by conducting employment checks on prospective borrowers. PaydayDaze explores how payday loan providers verify the employment status of applicants.

Payday lenders require borrowers to provide proof of income before approving their applications. It involves submitting recent pay stubs or bank statements showing regular deposits from an employer. Various lenders use third-party services to conduct more extensive background checks on potential customers.

Such services include employment verification databases like The Work Number or Equifax Verification Services. Assessing such sources enable payday loan providers to quickly confirm if applicants are currently employed and earning enough income to repay their debts.

Methods Used To Verify Employment

There are various ways that lenders use to verify a borrower’s employment.

- Lenders use paystubs to verify employment, as they provide a record of the employee’s wages and taxes withheld.

- Employment Verification Forms are another common tool to confirm an individual’s employment and salary history.

- Background checks are a more comprehensive approach to verifying employment, including contacting employers directly or using third-party services to validate the information.

- Payday loan companies use all three methods to validate an individual’s employment status.

- Lenders ask employers to provide references to the applicant’s employment history.

- Extra forms of identification are necessary to prove employment in a few cases.

Pay Stubs

Payday loan lenders commonly use Pay stubs to verify a borrower’s employment. Pay stub accuracy is key in determining if a borrower receives a loan, as it provides proof of income and helps determine the amount to borrow.

Pay stubs are not available or accurate every time. Alternative proof of employment, such as bank statements or tax returns, is necessary. The frequency of pay stubs plays a key role in verifying employment for payday loans. Various borrowers only receive physical pay stubs every month, while others access digital versions every two weeks.

Digital pay stubs are becoming more common due to their convenience and ease of access for employers and employees. The formatting of pay stubs varies between companies, making it necessary for lenders to understand different formats and verify they are legitimate before approving a loan based on them.

Employment Verification Forms

Employment verification forms are essential in the payday loan application process as they prove a borrower’s income and employment status. Legal requirements must be met when verifying employment, such as ensuring the form is accurate and up-to-date. Common mistakes include accepting falsified or outdated information, which leads to fraudulent loans.

Lenders accept various types of employment verification forms, including W-2s, pay stubs, and letters of employment. Self-employed borrowers pose unique challenges for payday loan lenders since they need to receive traditional pay stubs or have an employer verify their income.

Pre-employment background checks play a role in verifying employment by providing extra information on a borrower’s work history and criminal record. The rise of the gig economy has made it increasingly necessary for lenders to adapt their methods of employment verification to accommodate non-traditional sources of income.

Background Checks

Background checks are common among payday loan lenders to verify a borrower’s employment status. Such checks provide extra information on a borrower’s work history and criminal record, which is useful in determining their ability to repay the loan.

- Lenders conduct reference checks with previous employers to confirm the accuracy of payroll records and other income verification documents.

- Tax documents such as W-2s and 1099s, along with employment contracts, are necessary for background checks.

- Lenders must carefully review such documents to verify they are accurate and up-to-date before approving a payday loan.

Checking Employment History

Employment verification is key when applying for a payday loan because it provides proof of income and repayment capabilities. Most lenders use third-party services such as The Work Number or Equifax at the time of the application process to confirm an applicant’s employment information.

There are accuracy concerns with such a method since not all employers report data to the agencies, leading to reporting discrepancies. The databases sometimes do not contain accurate information about the borrower’s job history. An alternative proof is necessary before approving a loan.

Legal requirements mandate that applicants must have been in employment for a certain period before being eligible for a short-term loan. Verifying employment becomes increasingly key for lenders when reviewing if to approve or deny a borrower’s request for funds.

Borrowers must provide evidence of their current employment status and recent salary payments when obtaining payday loans. Lenders usually require pay stubs and bank statements from the last few months as part of their application process. Such documents allow them to evaluate an individual’s ability to repay while ensuring they comply with regulatory standards regarding interest rates and loan fees.

Overall, proper employment verification helps prevent fraudulent activities in the lending industry by providing transparency between lenders and borrowers while protecting both parties’ interests without compromising privacy rights or causing undue hardship on either side of the transaction.

Contacting Your Employer

The verification process is a key step in the payday loan application, and contacting your employer is one of the methods that lenders use to confirm borrowers’ employment status. Lenders require applicants to provide their employer’s name, address, phone number, and work schedule as part of the verification process. They contact the employer directly to confirm the provided details once they obtain the information from the borrower.

Various individuals have privacy concerns about disclosing their financial situation or personal information to their employers. Payday lenders try to limit the frequency of contact with employers while still meeting legal requirements for verification purposes in response to such concerns.

Various lenders accept other forms of income verification, such as bank statements or tax returns, instead of contacting employers directly as an alternative option.

Reviewing Bank Statements

Analyzing transactions is the next step in the process, as it allows lenders to see how much money is coming in and going out of the borrower’s account. The information helps them determine if the borrower has enough funds to repay the loan.

- The first step is to find inconsistencies. Reviewing bank statements helps spot inconsistencies that indicate fraudulent activity or errors on behalf of the borrower.

- Identifying income sources is necessary for verifying employment, as it shows where the borrower’s money is coming from and if they have a steady source of income.

- Lastly, monitoring cash flow enables lenders to detect irregularities, such as large withdrawals or deposits, that raise red flags about the borrower’s financial stability. Thoroughly examining bank statements enables payday loan companies to make informed decisions about lending money to borrowers while minimizing risk.

A one-way payday loan provider analyzes banking transactions by checking a borrower’s employment status before approving a loan. Using tools like identifying income sources and detecting irregularities in cash flow patterns, such lenders aim to minimize risks associated with lending money by ensuring that borrowers have reliable income streams and are not engaging in fraudulent behavior or misrepresenting their financial situation.

Importance Of Employment Status

Employment status is a key factor when it comes to payday loans. Lenders must check if the applicant has a stable income source, as it determines their ability to repay the loan. Most payday lenders verify employment through several methods, such as contacting employers, requesting pay stubs or bank statements, and conducting credit checks. Unemployed borrowers have difficulty obtaining a payday loan since their lack of regular income poses a high risk of default.

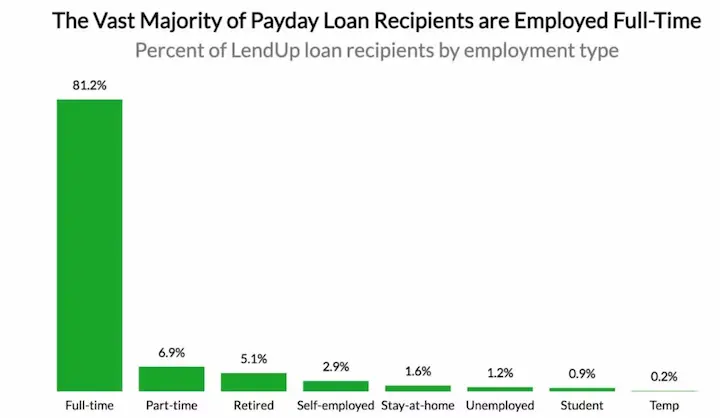

The impact of unemployment on getting a payday loan is key. The lack of steady work means borrowers resort to alternative income sources, such as selling personal items or borrowing from family and friends. Such options do not provide adequate funds for emergencies or unexpected expenses. Legal requirements mandate that lenders comply with state regulations regarding maximum lending amounts and interest rates. Part-time employees need help acquiring payday loans due to their reduced hours and lower earnings than full-time workers. Self-employed individuals find it difficult to obtain proof of consistent income required by various lenders, making them less likely candidates for payday loans altogether. The average payday loan borrower obtains a payday loan amount of $375, according to the Pew Charitable Trusts.

| Statistic | Payday Loans |

|---|---|

| Average amount borrowed | $375 |

| Average fees per loan | $55 per two weeks |

| The average length of time in debt | 5 months per year |

| Average fees paid per year | $520 |

| Percentage of borrowers using loans for regular expenses | 70% |

| Annual percentage rates (APR) | 391% average |

| Percentage of borrowers struggling to meet monthly expenses | 58% |

Conclusion

The methods used to verify employment when applying for a payday loan vary depending on the lender. Various lenders check employment history through databases, while others contact your employer directly to confirm your current status and salary. Reviewing bank statements helps determine if you have a stable income.

Employment status is key in obtaining a payday loan because it assures the lender of timely repayment. Obtaining a payday loan comes with risks, such as high-interest rates and potential debt traps. Weighing the benefits against the consequences is necessary before committing to a course of action.

Verifying employment when applying for a payday loan enables borrowers to repay their debts. It is imperative to understand both the advantages and disadvantages of such borrowing before making any decisions. Balancing one’s finances requires careful review and mindfulness to avoid financial ruin.

Frequently Asked Questions

What methods do payday lenders use to verify a borrower’s employment status?

Payday lenders verify employment by requesting pay stubs, calling employers directly, asking for employment letters, requiring proof of direct deposit, or using employment and income databases.

Do payday loan providers typically contact the borrower’s employer directly during the approval process?

In most cases, payday lenders do not contact the borrower’s employer directly, as many want to keep their loans private from their workplace. Lenders rely on paystubs, bank statements, or employment verification letters.

Are there alternative ways for payday lenders to check employment if the borrower is self-employed or has irregular income?

For self-employed or irregular income, lenders may verify through bank statements showing deposits, tax returns, business licenses, contractor agreements, or income databases. The approval process is more complex without regular paystubs.

Can borrowers apply for payday loans if they are unemployed or receive income from sources other than traditional employment?

Yes, borrowers can still apply but lenders will look for proof of government benefits, retirement/investment income, alimony, freelance work or other sources to qualify applicants who are unemployed or lack traditional employment.

How does employment verification impact the approval and repayment process for payday loans?

Documented income amount and source are key factors determining if approval is granted, loan amount and repayment terms. Steady verified employment indicates an ability to repay, lowering lender risk.