Have you ever wondered, “what is an unsecured personal loan?” It’s simply a type of loan where borrowers who need money obtain financing without pledging collateral. Despite having higher interest rates than secured loans, they are the best personal loans option for specific circumstances. Its in-depth guide explores when personal unsecured loans make sense, personal loan application, and tips on how to obtain unsecured personal loans guaranteed approval.

Overview of What is an Unsecured Personal Loan and Personal Unsecured Loan Types

An unsecured personal loan, known as personal installment loans, provides a lump sum of financing based on the borrower’s creditworthiness, as opposed to collateral like a house or car. It leads to one of the common queries: Is a personal loan secured or unsecured? The answer is it is either, but in this context, we explore the unsecured option. The borrower receives the loan amount upfront and commits to repay it in fixed monthly installments, generally over 1-5 years.

Unsecured loans differ from secured loans and revolving credit:

- No collateral required – The lenders accept a greater risk, resulting in strict approval criteria. Often, they are labeled as high risk personal loans due to higher interest rates. Nevertheless, no lien is placed on the borrower’s property.

- Fixed monthly payments – The loan maintains a set repayment schedule with predictable payments each month.

- Fixed interest rate – The kind of low interest personal loan maintains a consistent rate over the full loan term. It helps you know the personal loan rates you’ll have to pay.

- Set payoff date – The loan agreement clarifies the duration required to clear the balance if you make consistent on-time payments.

- Flexible use – The funds are freely used for any legal purpose once disbursed.

Pros and Cons of Best Unsecured Personal Loans and Unsecured Personal Loans Bad Credit

They have potential drawbacks, while unsecured personal loans provide swift access to financing:

Pros

- Fast personal loans with funding frequently available in 1-3 business days.

- You consolidate high-interest debt into one payment.

- Showcases responsible credit use that improves your score.

- Facilitates prepayment without penalties.

- No risk of losing collateral if unable to repay.

Cons

- Higher interest rates than secured loans, making them not the best unsecured personal loans.

- Strict credit score requirements for approval lead to unsecured personal loans bad credit standing.

- More interest in lengthy 5-year terms.

- Credit inquiries temporarily lower your score.

- Loan amounts are limited based on your income and debts.

Do Personal Loans Unsecured Make Sense, and Is a Personal Loan Secured or Unsecured?

Effective management of personal loans, which includes emergency personal loans, largely depends on understanding their pros, cons, and use cases. They make sense when you need fast personal loans and manage to meet the repayment requirements. For anyone who prefers to manage their financial tasks over the internet, they assess easy-to-apply-for personal loans online.

There are certain situations where personal loans unsecured are suitable and greatly beneficial while not intended for everyone. Here are certain of the circumstances that necessitate the types of loans:

Debt Consolidation

Unforeseen expenses or large credit card debts are easily managed by consolidating several high-interest liabilities, such as credit card debt, into one single payment of a debt consolidation loan. The efficient strategy helps organize finances, pay off balances faster, and potentially lower the loan interest rate to an affordable one. The method is best suited for disciplined borrowers who accumulate less debt post-consolidating.

Major Expenses

Personal expenses like a dream wedding, adoption fees, burial expenses, or hefty medical bills are comfortably covered by personal loans unsecured. It allows you to smoothly pay the costs over time rather than succumbing to high-interest credit cards.

Home Improvements

Use improvement loans for home maintenance, such as kitchen remodeling or roof replacement, thereby increasing your property’s value and your living satisfaction. It presents an alternative to resorting to pricey home equity loans.

Auto Purchases

An auto loan is the quick lifesaver you need as compared to bad credit auto car financing if a swift purchase of a car is essential.

Elective Medical Procedures

Particular procedures like dental work, Lasik eye surgery, or fertility treatments need to receive adequate coverage by health insurance. Personal loans unsecured offer a way to bridge this coverage gap.

Education and Training

Online loan options fund continuing education, career improvement programs, or professional certifications. The long-term income benefits accrued by the learning opportunities are worth the financing costs.

Emergency Expenses

During financial emergencies like unexpected medical bills or pressing home repairs, personal loans enable quick access to funds when contingency savings prove insufficient.

What Credit Score is Needed for Unsecured Personal Loans Guaranteed Approval?

To be eligible for credit approval for personal loans unsecured from mainstream lenders, they require a good credit score – generally 660 and above. Those with “fair” scores within the range of 580-659 still qualify with certain lenders but at competitive interest rates, which are usually higher. Excellent credit scores above 720 provide the most loan options and the lowest interest rates.

Here are certain credit requirements and minimum credit score requirements lenders contemplate along with your financial obligations:

- Low debt-to-income ratio (total monthly debt under 36% of gross income)

- No missed payments on credit accounts in the past 12 months

- Lengthy credit history with different types of credit accounts

- Minimal recent credit inquiries, avoiding too many in a short period

Borrowers with “poor” credit scores below 580 generally do not qualify with mainstream financial institutions. Nevertheless, specialized subprime direct lenders provide $4000 personal loans, $3000 dollar personal loans, or even $5000 dollar personal loans to people with challenging credit histories, albeit at higher interest rates.

How Much Do You Borrow with Personal Unsecured Loans?

Loan proceeds range from $1000 dollar personal loans up to $40,000 for borrowers meeting the eligibility requirements, with the average from $9,000 to $15,000. Exact loan limits depend primarily on your source of income, existing debts, and credit profile. But lenders assess factors such as:

- Gross monthly income (generally, for a guaranteed approval, most require proof of income showing at least $2,500 per month)

- Total monthly debt obligations like car loans and credit cards

- Aspects of your credit history beyond just the score

- How you plan to use the personal loan funds

- Any existing relationship and accounts you have with the lender

Those with higher incomes, lower debts, and excellent longtime credit histories qualify for larger loan amounts, like $2000 dollar personal loans, at the upper end of lenders’ caps.

Applying for an Unsecured Personal Loan and Unsecured Personal Loans Bad Credit

The application process for a loan, especially with online applications, has been streamlined and become even more convenient due to advances in technology:

Pre-Qualification

Many lenders allow you to check potential rates and approval chances via a soft credit pull without impacting your score. The step helps you easily compare viable offers and speeds up the instant approval process.

Initial Application

You are required to complete a short application with personal details, income, housing costs, debts, bank info, and loan purposes. The instant approval process is frequently fast, only taking 5-10 minutes with direct lenders.

Identity Verification

As part of the eligibility requirements, lenders verify your identity and income sources, frequently requesting scans of a valid ID, pay stubs, tax documents, and bank statements.

Credit Check

The lender performs a hard inquiry into your credit history to review your full payment history, debts, score, and other factors in their decision.

Loan Decision

Certain lenders even offer a same day deposit of your loan proceeds depending on their processing times if approved.

You promptly receive a skillfully made loan decision shedding light on your personalized rates, including the interest rate, fees, terms, and monthly payment amount. The loan process further incorporates the issue of final loan documents, defining funding time and events in the event of late payments or if a borrower defaults.

Funding

The reputable lender initiates a speedy money transfer upon the document’s signature. Often, same-day funding is attainable, with approved loans to borrowers getting deposited electronically into your bank account within 1-3 business days.

Expanding our reach and commitment to providing accessible financial solutions, PaydayDaze proudly operates in the following American states. Whether you’re looking for unsecured personal loans in the heart of the Midwest or on the bustling coasts, our services are available to meet your financial needs. Discover our presence and explore the options available in your state below.

| AL / Alabama | AK / Alaska | AZ / Arizona |

| AR / Arkansas | CA / California | CO / Colorado |

| CT / Connecticut | DE / Delaware | DC / District Of Columbia |

| FL / Florida | GA / Georgia | HI / Hawaii |

| ID / Idaho | IL / Illinois | IN / Indiana |

| IA / Iowa | KS / Kansas | KY / Kentucky |

| LA / Louisiana | ME / Maine | MD / Maryland |

| MA / Massachusetts | MI / Michigan | MN / Minnesota |

| MS / Mississippi | MO / Missouri | MT / Montana |

| NE / Nebraska | NV / Nevada | NH / New Hampshire |

| NJ / New Jersey | NM / New Mexico | NY / New York |

| NC / North Carolina | ND / North Dakota | OH / Ohio |

| OK / Oklahoma | OR / Oregon | PA / Pennsylvania |

| RI / Rhode Island | SC / South Carolina | SD / South Dakota |

| TN / Tennessee | TX / Texas | UT / Utah |

| VT / Vermont | VA / Virginia | WA / Washington |

| WV / West Virginia | WI / Wisconsin | WY / Wyoming |

Comparing Best Unsecured Personal Loans Offers from Lenders

The decision about which loan offer to accept is one of the significant financial decisions. It’s recommended to compare personalized loan offers from multiple lenders to get the best loan cost. Here are essential factors to assess when evaluating options:

- Interest rates – A small rate difference of 1% or less save hundreds over the loan’s term.

- Origination and admin fees – These upfront fees normally range from 1-6% of the loan amount.

- Flexible loan terms – Confirm the lender provides your ideal flexible repayment terms.

- Prepayment policies – Most lenders allow clearing the balance early with no penalties.

- Funding speed – Online lenders generally offer fast 1-3 day funding, and certain even facilitate same-day funding.

- Customer service – Look into reviews about the lender’s support, particularly when dealing with payment issues.

Evaluating multiple offers and shopping around turn out to be beneficial in securing the best rates and terms that suit your situation before committing.

Tips for Getting the Best Interest Rate on Unsecured Personal Loans Guaranteed Approval

Certain other factors influence what APR a lender offers you, while creditworthiness is a significant determinant of your interest rate:

- Excellent credit scores over 720 generally qualify for the lowest rates.

- Keeping total monthly debts low in comparison to income aids in getting loans for debt consolidation

- Unambiguous justification for how the loans are used.

- Opting for a shorter 12-24 month loan term for more flexible payment options

- Building a relationship with the lender over time frequently opens doors for bad credit loans.

- Stay clear from loan applications during periods of economic uncertainty, as it leads to high-interest rates.

Adversely, rates for people with lower credit scores under 600 are noticeably high across the board, even for no credit check loans.

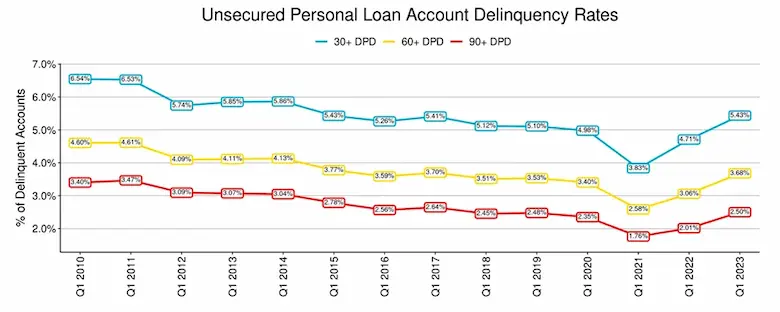

The average personal loan debt per borrower in the U.S. is $10,749, according to Bankrate. The interest rate charged varies depending on the size of the loan requested. Larger sums have higher rates due to increased risk for lenders. The table below sheds more light on the data.

| Scenario | Data |

|---|---|

| Average personal loan interest rate | 10.81% |

| Average personal loan debt per borrower | $10,749 |

| The personal loan balance of Boomers | $20,370 |

| Loan delinquency rate increase | 54% since last year |

| The expected delinquency rate in 2023 | 4.30% for unsecured loans |

| Funding times impact on Interest rate hikes in 2022 | 7 times by Federal Reserve |

| Current federal funds target rate | 4.25% to 4.5% |

| Projected interest rate hike in 2023 considering funding times | over 5% by Federal Reserve |

Borrowing Responsibly with Personal Loans Unsecured

Despite the allure of a fast approval process, prudent borrowing requirements must be practiced when acquiring personal loans. Guarantee you only accept a minimum loan you realistically afford to repay on schedule assures that the loans enhance rather than harm your financial health. Using a loan calculator helps estimate total interest costs over the payback period. You’re preventing any possibility of applying for bad credit loans.

- Develop a clear budget, reviewing items such as your annual income and plan for monthly debt payments. Have a clear understanding of where your repayment money originates each month to ensure prompt payments and to avoid a potential Late payment fee.

- Conduct a thorough examination of the loan terms, fees, and policies. Don’t hesitate to seek explanations before penning your signature if there are unfamiliar financial products or terms.

- Start by improving your credit if it is below 620. Rectify discrepancies in your credit reports and ensure automatic payments are set up for your current debts to pay them on time every month.

- Review lower-interest alternatives such as securing a loan from a 401k, home equity loan, credit union, or family members with a range of purposes in memory. These offer a more favorable option for borrowers before thinking of a loan for debt consolidation.

- Try not to engage in “loan stacking” – obtaining high-risk personal loans guaranteed approval by direct lenders that become difficult to manage. Allow a significant gap between loans.

- Use autopay from your bank for Direct payments to guarantee your payments are never overdue. Don’t forget to ensure funds are ready each month.

Frequently Asked Questions about Unsecured Personal Loans Bad Credit

What credit score is needed to qualify?

Mainstream lenders generally require a credit score of at least 660. Getting approval for a traditional loan is hard if your score is below 600. But if your score is above 720, you have the best options.

How quickly do I get loan funds?

Online lenders who use electronic transfers frequently deposit funds by the day after approval within 1-3 business days. Traditional banks take longer, up to a week, if they’re issuing physical checks.

Must I take the maximum loan amount offered?

No, you must only borrow in tune with your income requirement and according to your needed purpose. Maxing out a loan that is hard to repay puts your future financial health at risk.

What happens if I miss a payment?

Most lenders offer a brief 10-15 day grace period. Beyond this, you must pay a Late payment fee ranging from $15 to $40, and further missed payments negatively affect your credit score.

Do I pay off my personal loan early?

Many lenders are flexible and allow early repayments without prepayment penalties. Particular charge fees equivalent to 1-3 months of interest depending on their policies, so be sure to check beforehand.

Does applying hurt my credit score?

Carrying out a credit check lowers your score by a few points. Nevertheless, responsibly managing a loan, such as a credit card consolidation loan, over time rebuilds your credit score by demonstrating creditworthiness. It is reinforced by the Ease of application offered by many modern lending platforms.

Do I get a cosigner for a better rate?

Yes, certain popular lenders allow creditworthy cosigners to secure favorable terms. Nevertheless, bearing in memory cosigning loans is risky as it comes with lengthy terms and legal obligations that impact both parties, especially without a steady income. Do so only after gaining a full understanding of the aspects.

What interest rate do I expect to pay?

Interest rates vary widely. Currently, they average between 10-30% for unsecured personal loans, depending on your specific credit profile. Excellent credit scores under 720 qualify for rates on the lower end of this wide range. Certain lenders offer a soft credit inquiry for estimating potential rates, improving your customer experience.

The Bottom Line on Unsecured Personal Loans Guaranteed Approval

Unsecured personal loans offer an accessible way to finance large, frequently unexpected expenses over an extended repayment period when used wisely. These loans serve a variety of purposes, from managing personal lines of credit to pursuing educational purposes. Nevertheless, the higher interest rates make it costly for current borrowers reviewing long-term borrowing. To navigate through the common types of loans effectively, research various lenders, contrast different loan offers thoughtfully, and commit to secured options or flexible terms only when the sums are within your affordable range. Don’t forget that loans come in a variety of loan amounts and are a valuable financial tool rather than a burden when used wisely.