Credit scores hold a significant influence in determining financial stability and access to loans. A high credit score opens the door to numerous financial opportunities, while a low one limits them. It is challenging for individuals to understand what factors contribute to raising their credit scores. The good news is that there are several tried-and-tested methods of increasing your credit score, such as maintaining a positive payment history and ensuring that your credit utilization rate remains low.

Monitoring your credit report regularly, improving your credit score, and maintaining low debt levels by adopting healthy habits such as paying bills on time can improve your chances of achieving an excellent credit score. An updated credit file with the major credit bureaus is crucial for more accurate results. The article explores various strategies that help raise your credit score and provides insights into how the tactics work.

SUMMARY

- Monitoring credit reports regularly and maintaining low debt levels help improve credit scores.

- Credit scores are influenced by payment history, the amount owed, and the length of credit history.

- Establishing credit takes time and effort, and limiting credit report inquiries is necessary.

- Score increases can be achieved by paying on time, one of the most effective ways to raise credit scores.

- Managing credit utilization and keeping credit card balances low help improve credit scores. Credit limit increases can also play a role in managing utilization.

- Reviewing credit reports directly with major credit bureaus is necessary to understand and dispute errors that negatively impact credit scores.

Understanding Credit Score

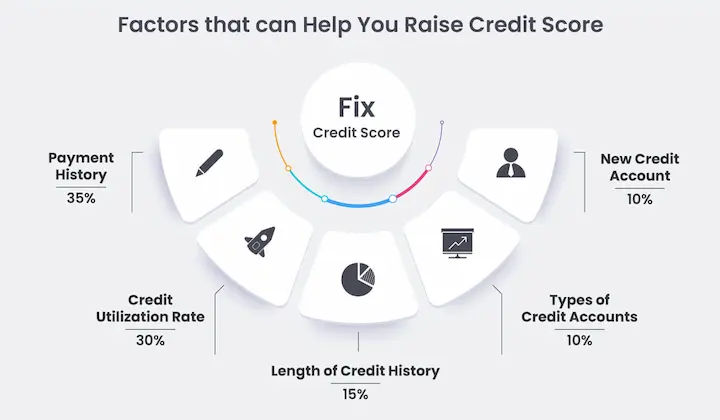

A credit score is one component that lenders look at when evaluating an individual’s ability to repay money borrowed. According to Experian, credit scores range from 300-850; higher numbers indicate greater reliability. Credit score has three main components, payment history (35%), the amount owed (30%), and length of credit history (15%), according to Investopedia. A credit file maintained by the major credit bureaus influences these factors.

The table below shows different scenarios for credit scores and how the three main components, along with factors like credit utilization rate and positive payment history, influence them:

| Credit Score Range | Payment History (35%) | Amount Owed (30%) | Length of Credit History (15%) |

| Excellent (800-850) | On-time payments for all debts, no delinquencies or collections | Low credit utilization, no balances on revolving credit accounts | Long credit history with a mix of credit accounts (e.g., mortgage, auto loan, credit cards) |

| Good (700-799) | On-time payments for most debts, few minor delinquencies or collections | Moderate credit utilization, small balances on revolving credit accounts | Medium credit history with a mix of credit accounts |

| Fair (600-699) | Occasional late payments, delinquencies, or collections | High credit utilization, large balances on revolving credit accounts | Short credit history with a limited mix of credit accounts |

| Poor (300-599) | Frequent late payments, many delinquencies or collections | Very high credit utilization, large balances on revolving credit accounts | Very short credit history with few or no credit accounts |

The table shows that credit scores are influenced by three main factors, payment history, the amount owed, and length of credit history. The table includes four credit score ranges (Excellent, Good, Fair, and Poor) and shows how the three main components affect each range.

An individual with an excellent credit score (800-850) has a history of on-time payments for all debts, low credit utilization, and long credit history with a mix of credit accounts. An individual with a Poor credit score (300-599) has a history of frequent late payments, high credit utilization, and a very short credit history with few or no credit accounts. Lenders use the table to evaluate the creditworthiness of an individual and make informed decisions on lending money.

Establishing Credit

Building a good credit score is like building trustworthiness in any relationship; it takes time and effort. The first step towards establishing credit is maintaining records of your financial transactions, which helps lenders and credit card issuers understand your spending habits and how you manage your money. Applying for secured cards can be a helpful starting point, as these cards require a security deposit that often determines the account’s credit limit.

Limiting inquiries on your credit report is necessary, as too many negatively impact your score. Researching offers from different credit card companies before applying for credit is necessary to get the best deal while avoiding unnecessary inquiries. Sharing accurate information with each credit reporting agency helps improve the accuracy of your monthly statements.

Applying for credit responsibly means only taking loans or opening new lines of credit when necessary and being diligent about making monthly payments on time to avoid damaging your score. This will help elevate your credit score category over time as you demonstrate sound financial decisions. Individuals establish a strong foundation for their credit history and raise their credit scores over time.

Making Payments On Time

Making Payments on Time is one of the most effective ways to raise credit scores. Consistent and timely payments show lenders you are responsible with money, increasing your creditworthiness. Consolidate debt or set alerts for payment due dates to make timely payments.

Regularly monitoring reports helps identify any errors or discrepancies, allowing you to address them before they negatively impact your score. Shopping around for competitive interest rates and using cash instead of relying solely on credit cards reduce the risk of missed payments and high balances, positively impacting your credit utilization ratios.

Managing Credit Utilization

Managing credit utilization is one of the most effective ways to raise your credit score, according to a recent survey. Securing loans and using cards responsibly are necessary factors that contribute positively to your credit score. Understanding the debt-to-income ratio helps you manage debts effectively and avoid taking on too much at once. Building a strong credit history with consistent payments over time benefits your overall score and improves your standing with credit card companies.

Monitoring your credit activity and score regularly is necessary to identify any credit report errors or fraudulent activity that negatively impact it. By utilizing credit repair services and engaging in good financial habits, you will improve your creditworthiness and achieve better financial stability in the long run without getting into risky behaviors such as excessive borrowing or overspending.

Keeping Credit Card Balances Low

Managing credit utilization is a significant credit score factor. Another essential aspect of demonstrating positive credit behavior and improving one’s credit score is keeping credit card debt and balances low. Paying off debt and reducing expenses are the two primary ways to achieve this goal.

It is necessary to track spending habits closely by creating a budget plan that outlines monthly expenditures and income sources. One must maintain limits on their credit cards and avoid maxing them out regularly.

Improving credit mixes, such as having different types of loans like installment or revolving debts, helps boost your score as it demonstrates responsible borrowing behavior. Achieving good financial health takes commitment and discipline but leads to long-term financial stability rather than temporary relief from poor financial decisions.

Disputing Errors On Credit Report

Reviewing credit reports is a necessary step in understanding and disputing credit report errors that are present. Understanding the dispute process and employing credit repair services when necessary help errors be corrected promptly and help to maintain a healthy credit score.

Reviewing Credit Reports

Reviewing credit reports is a necessary step in disputing errors on credit reports. It ensures that your credit history and score are accurate, significantly impacting securing loans and building a positive credit history. By reviewing your credit report regularly, you can detect any errors or inaccuracies that adversely affect your credit score.

The process involves checking for incorrect personal information, fraudulent accounts or activities, and other discrepancies that negatively impact your financial standing. It’s necessary to review your credit report at least once per year to maintain the accuracy of your financial records and improve your chances of obtaining better loan terms and building credit. Implementing a credit improvement plan and working with a credit card company can greatly contribute to positive changes in your financial health.

Dispute Processes

Understanding the dispute process is essential in Disputing Errors on Credit Reports. You find that issues still need resolving even after reviewing your credit report for inaccuracies and errors, which is where dealing with collectors comes into play. Credit scoring models rely on accurate information, so clearing errors is crucial for those with a bad credit score.

The dispute process involves notifying credit bureaus of any discrepancies or mistakes on your credit report and providing evidence to support your claim. It is a daunting task, but it’s necessary to persevere through the process as it has significant implications for securing secured loans and improving your overall financial standing. Secured credit card applications often require accurate credit reports, so resolving disputes directly affects this credit scoring factor.

Avoiding Opening Too Many Accounts

As tempting as it is to open multiple new accounts in the hopes of improving your credit score, doing so actually has a negative impact because opening too many accounts within a short period makes you appear financially unstable and increase the number of inquiries on your credit report, which lower your score. Focus on reducing debt and building trust with current creditors by making timely payments and keeping balances low. Credit builder loans are a more strategic option for those looking to improve their credit score without risking a high utilization rate. Tracking spending habits and minimizing inquiries help improve your score over time.

Final Thoughts

Maintaining a good credit score is necessary for financial stability and loan access. The three main factors influencing credit scores are payment history, the amount owed, and the length of credit history. Individuals raise their credit scores by making timely payments, managing credit utilization, keeping credit card balances low, and disputing errors on their credit reports. Building a strong credit history takes time and effort, but it leads to long-term financial stability.

Frequently Asked Questions

How can I increase my credit score quickly?

Making timely payments, paying down debts, limiting hard inquiries, fixing errors on your credit report, and keeping credit card balances low can help increase your credit score quickly.

What are the key factors that positively impact my credit score?

Payment history, total debt, credit age, new credit inquiries, and credit mix are key factors. Responsible use of credit and reducing debts have the most positive impact.

Does making on-time payments improve my credit score, and if so, how much?

Yes, a consistent record of on-time payments can significantly improve your credit score over time. It demonstrates responsibility and is a key scoring factor.

Are there any specific actions or strategies to boost my credit score after a financial setback, such as bankruptcy or late payments?

After financial setbacks, focus on timely payments, lowering credit utilization, mixing types of credit, disputing errors, and allowing time for improvement. Avoid new credit inquiries in the short term.

Can you explain the role of credit utilization and its impact on raising one’s credit score?

Credit utilization is the ratio of credit used to available credit. Keeping this low on all cards demonstrates responsible usage and helps raise scores. High utilization lowers scores.