An unexpected expense or financial emergency leaves you exploring options for urgent funds. Understanding how fast payday loans work—including their costs and regulations in Iowa—is essential for informed decisions. While services like $100 loans online or $1000 loan requests may seem accessible, carefully review all terms.

This guide provides:

- Insights into short-term lending options for residents in Mason City and Iowa City

- Transparent breakdowns of potential costs and finance charges

- Key Iowa regulations protecting borrowers

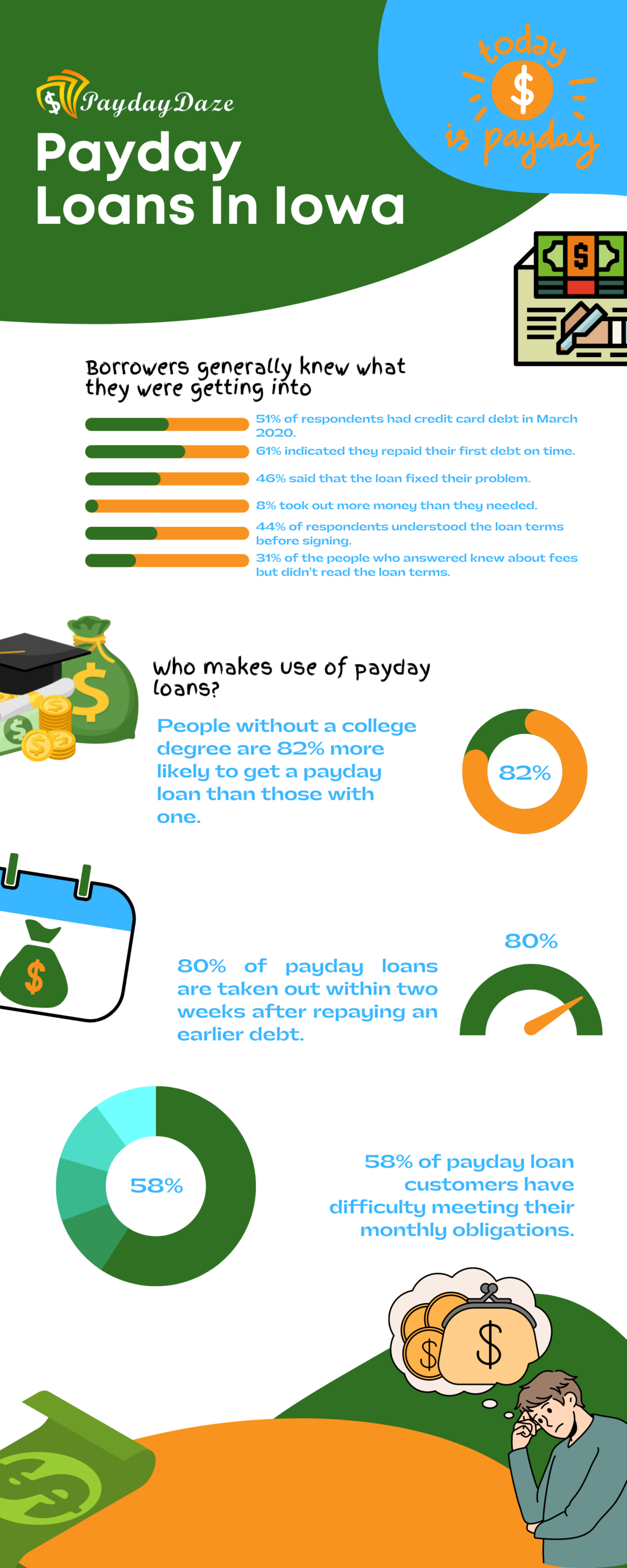

- Responsible usage strategies to avoid debt cycles

- Alternatives to traditional payday solutions

- FAQs about online loan requests in Iowa

Let’s explore how these financial services operate.

How Do Online Loan Requests Work in Mason City and Iowa City?

Short-term financial solutions provide access to funds typically repaid around your next pay period. To explore options, you’ll need to submit basic information for lenders to review. While approval isn’t guaranteed, many lenders respond quickly to requests.

If connected with a lender, funds could be deposited as soon as the next business day after approval. Residents in Mason City or Iowa City may benefit from streamlined processes, though timing depends on individual lender policies.

Most loan amounts range from $100 loan requests to $1000 loan requests, with Iowa regulations capping maximum amounts at $500. Repayment terms typically span 2-4 weeks.

What Makes Online Loan Requests Appealing for Urgent Needs?

These services can be valuable for those needing to explore financial options quickly. Key features include:

- Quick responses – Many lenders provide fast decisions, with possible next-business-day funding if approved

- Accessible options – Services may connect you with lenders who consider various financial situations

- Streamlined process – Submit requests online anytime through secure forms

While convenient, always review all costs and repayment terms carefully before proceeding.

Iowa residents can explore financial solutions through our network of providers in these key cities:

| Des Moines | Cedar Rapids | Davenport |

| Sioux City | Iowa City | Ankeny |

| West Des Moines | Ames | Waterloo |

| Council Bluffs | Dubuque | Urbandale |

| Marion | Cedar Falls | Bettendorf |

Understanding Costs of Short-Term Financial Solutions

Iowa law caps charges at:

- 15% on the first $100

- 10% on amounts between $101-$500

- Maximum $15 maintenance fee

For a 14-day $500 request, maximum charges would be $50. Always confirm exact terms with lenders before proceeding.

Responsibly Managing Financial Requests

To use these services wisely:

- Request only what you can comfortably repay

- Confirm repayment dates align with income schedules

- Understand all lender terms before accepting funds

- Explore alternatives first when possible

Remember: Late payments may incur additional fees from both lenders and financial institutions.

Iowa Regulations Protecting Borrowers

Key consumer protections include:

- Strict limits on charges and interest

- Single active loan maximum

- Rollover restrictions to prevent debt cycles

- Military borrower APR caps at 36%

Alternative Financial Solutions

Consider these options before proceeding:

- Credit union alternatives with lower rates

- Payment plans with service providers

- Community assistance programs

- Secured credit options

Frequently Asked Questions

What are Iowa’s loan amount limits?

State law limits maximum amounts to $500. Lenders may offer lower amounts based on individual circumstances.

Can I have multiple active requests?

Iowa prohibits multiple simultaneous financial arrangements to protect consumers.

What if repayment becomes difficult?

Contact your lender immediately to discuss options. Many offer payment plan alternatives.

Do lenders check credit history?

Lenders may perform soft credit checks that don’t affect your score. Final approval decisions vary by lender.

Note: This service connects users with third-party lenders. We are not a direct lender and cannot guarantee approval. All financial decisions should be made after careful review of lender terms. Late payments may incur additional fees.