Short-term loans or payday loans promise quick payday loans when you’re in a pinch, but in the Sunflower State, they have sky-high interest rates, the risk of falling into debt, and the need to borrow money online. The comprehensive guide highlights payday lending in Kansas, the ups and downs of payday loans Kansas city KS, regulations, payday advance advice, and alternative choices.

Overview of Payday Lending in the Sunflower State

The idea of getting payday loans online same day became legal in Kansas in 1993 through deferred deposit loans. Today, hundreds of payday loan storefronts operate nationwide, making it relatively easy to get Kansas city payday loans online.

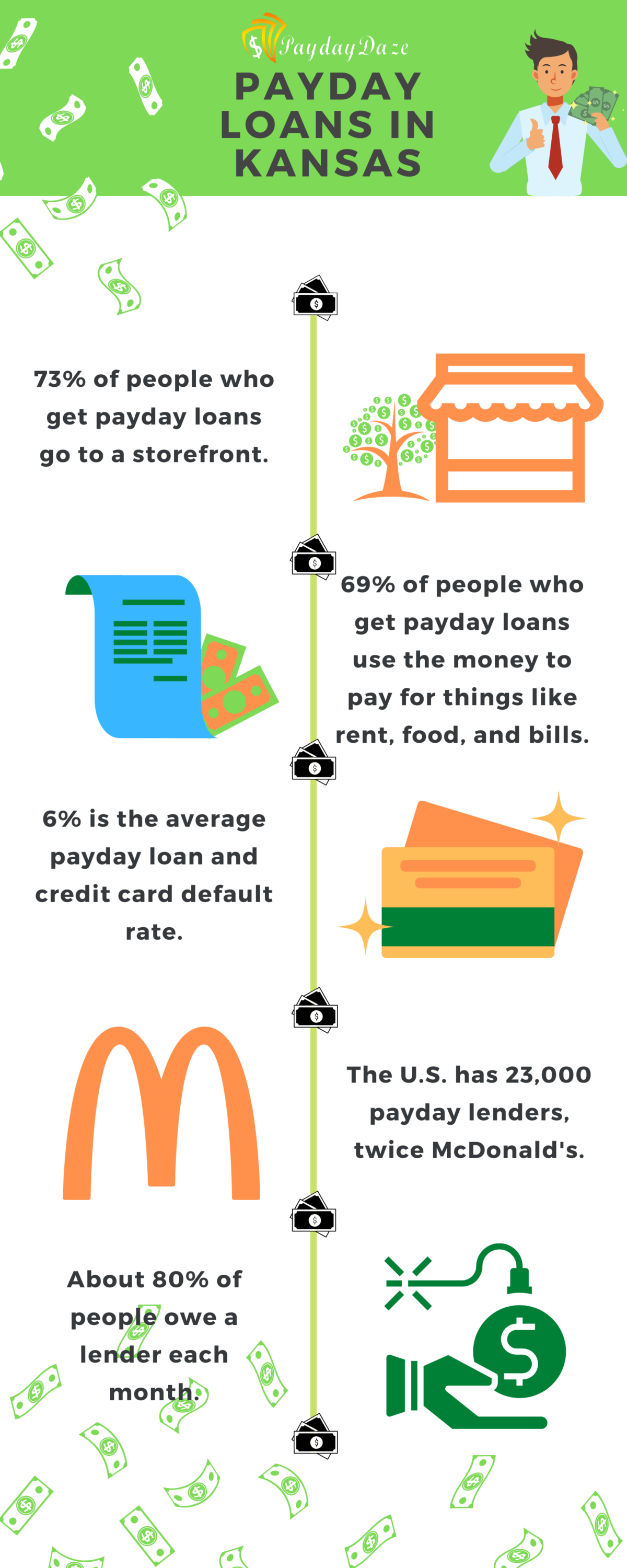

Here are key facts on payday loans in Kansas:

- Maximum Loan Amount: $500 cash advance

- Loan Term: 7-30 days

- Rollovers Permitted: No limit

- Finance Charge on a 14-day $100 Loan: $15

- APR on a 14-day $100 Loan: 391%

A 391% APR seems outrageously high; it’s in the payday loan industry. The real blow comes from rollover fees, which trap borrowers in cycles of crippling debt. We’ll dive into that later in the risks section. This progressive scheme ensures that pressing credit requirements are addressed while firmly putting a cap on rates, drawing a distinction from adjacent Missouri, and offering more affordability than Oklahoma’s guidelines.

But first, let’s delve into the pros and cons of payday loans like payday loans Kansas City and online payday loans Kansas.

Perks of Payday Loans in Kansas City, KS: Advantages of Kansas City Payday Loans Online

In the face of financial distress, fast payday loans offer benefits.

1. Instant access to cash

Instant payday loans and instant cash loans are the main allure of payday loans. They usually offer access to cash on the same day, a lifeline for people with an urgent need money now situation, and a few other options.

2. Minimal eligibility prerequisites

Payday lenders require proof of income and a bank account and do not conduct intensive credit examinations, which eases the process for people with poor credit or no credit to borrow money online. There are no credit checks accepted for loans.

3. Catering to high-risk borrowers

Traditional lenders keep a distance from borrowers with low credit scores or insufficient credit history. Payday lenders cater to high-risk borrowers who banks overlook.

4. Accessible locations

The best online payday loans are just a few clicks or a short drive away, with hundreds of quick loans outlets statewide. Apply online and have your cash advance loans in record time.

5. Keep borrowing costs transparent

The fees and interest rates tied to payday loans, including no credit check loans and small payday loans online no credit check, are clearly stated in loan agreements. There are no hidden costs or surprises, ensuring that individuals in desperate need and in need of a payday loan immediately are mindful of all costs associated.

Cons of Payday Loans in Kansas: Drawbacks

Despite the quick instant approval and being perfect for unexpected expenses, one must know the significant cons of opting for such types of loans, including the ubiquitous payday loans for bad credit:

1. Staggeringly high APRs

The average APR of 391% on Kansas payday loans, even touted as no credit check loans guaranteed approval, is exorbitantly higher than rates on credit cards or traditional loans. The high-risk loans accrue interest daily, so costs balloon if not repaid quickly.

2. Short repayment terms

The usual terms, as seen in products like the 1-hour payday loans no credit check, are merely 7-30 days, with the next payday being the due date, which provides little time to repay the one cash loan, placing borrowers with a bad credit score at risk of accruing rolled over fees or defaulting.

3. Rollover fees lead to debt cycles

In Kansas, payday loans, including no credit check loans Kansas City and 3000 loans no credit check in Kansas, are rolled over without limit on how many times. Each rollover summons new fees, which trap borrowers in a vicious cycle for months, distinguishing it as a high-risk installment loan option.

4. Aggressive collection tactics

Kansas payday lenders, from traditional cash loans to no denial payday loans, sue borrowers after just one missed payment. Other lenders wrongfully threaten jail time. Even legal practices are fiercely aggressive.

5. No credit check

Though lax credit checks are a boon for customers seeking no credit check payday loans guaranteed approval, it hampers building good credit through punctual repayments since the types of loans are rarely reported and easy to get instant approval.

6. Access to bank accounts

Lenders gain access to borrowers’ bank accounts to withdraw payments, which is quite common with online loans and emergency loans. Insufficient funds lead to overdraft fees of up to $35 per attempt.

7. Does not solve underlying problems

Despite same-day deposit and approval features, payday loans offer temporary relief rather than a long-term solution for people facing acute financial shortages. They ease a symptom, not the root cause.

As displayed, the risks and costs overshadow the short-term benefits of payday loans for many borrowers. Next, let’s examine the regulations governing the high-risk loans in Kansas.

Legal Framework of Online Payday Loans Kansas

To shield consumers, Kansas imposes certain limits and requirements on payday loans, including:

- Maximum loan amount of 500 dollars or 30% of gross monthly income.

- Finance charges capped at 15% of the total loan amount.

- Only one bad credit personal loan is allowed per borrower at a time.

- State database prevents issuing new loans with multiple outstanding, checking credit history, including that of poor credit history.

- Financial services provider must post fee schedules and have written loan agreements offering flexible repayment options. It is easy to find the most reliable loan provider near me.

- Borrowers get a minimum 6-month repayment period after loan renewal, ensuring minimum payment.

- Lenders must comply with state collection practices laws.

Key loopholes remain, such as no limits on back-to-back renewals, which leaves the door open for chronic debt cycles if borrowers struggle to repay. High risk loans and other short-term loans cause such cycles that are hard for people with poor credit history to break.

Other consumer advocates argue Kansas regulations, such as capping rollovers, limiting store density, or lowering APR ceilings, must go further. For now, the state maintains relatively relaxed oversight.

Payday Loan Alternatives in Kansas: Safer Options

For Kansans facing emergency expenses or financial hardship, safer and more affordable financial products exist. Allowing you to make an informed decision and know the alternatives before getting a high-interest payday loan or bad credit loans guaranteed approval.

Payment Plans with Creditors

Contact financial services provider or lenders, landlords, or utility companies directly to request extended lines of credit or payment plans. Most work with consumers to recoup debts and avoid default or service disruptions, offering flexible repayment options suitable to your source of income.

Employer Cash Advances

Other companies offer paycheck advances to employees as a benefit. The amount comes from future pay, but no fees or interest exist. Ask your HR department if this is an option, providing you with an alternative source of loan funds in advance.

Borrow from Family or Friends

For many, asking loved ones for help is preferable to predatory lending. Draft a repayment period agreement to keep terms clear. They even agree to waive or lower interest rates, providing competitive interest rates compared to commercial loans.

Credit Union Payday Alternative Loans (PALs)

Kansas credit unions offer PALs up to $500 with APRs capped at 28%. To qualify, you must be a member for at least a month and complete credit counseling.

Online Personal Loans

New online lenders like Upstart and SoFi use algorithms to approve people with bad credit personal loans at competitive rates. These installment loans within a few minutes have longer repayment periods, enabling easier management of monthly payments.

Balance Transfer Credit Cards

Balance transfer credit cards provide lines of credit with low-interest or deferred-interest promotions and offer relief from loan payment burdens. You must understand the terms and conditions before committing.

Transferring high-interest credit card balances to a 0% promotional credit card provides temporary relief. The financial solution must not be overlooked, especially if you’re able to handle a $1000 loan online. Have a plan to pay off the balance before rates spike, ensuring you pay off the loan on time.

401(k) Loans

Borrowing from your 401(k) stipulates access to emergency cash with reasonable rates and flexible repayment terms, a specific type of loan taken as a last resort option since it halts retirement savings.

Tips for Payday Loan Borrowers in Kansas: Navigating Payday Loans Kansas City, KS

Understand the following tips first if ever you need a payday loan immediately:

- Borrow only what you realistically repay by the due date and steer clear of rollovers to maintain a good credit score.

- Formulate a concrete repayment plan immediately to avoid budget issues later.

- Hold open conversations with lenders in advance if you sense payment issues in the future to avert missed payments and fees.

- Avoid taking loans for discretionary purchases—allocate them only for unavoidable emergencies, even a small $100 loan online.

- Compare lender options to view the best loan term options and get the lowest fees. Don’t presume one place is inherently better than another.

- Think about cheaper alternatives like credit unions that are an option for smaller loans.

- Rehabilitate your credit to meet any credit score requirements so you qualify for better loan options in the future.

- Pursue financial counseling to address the root of the problem rather than masking symptoms with payday loans.

Frequently Asked Questions about Payday Loans in Kansas:

Are payday loans legal in Kansas?

Kansas first authorized payday lending in 1993 through deferred presentment loans. Deferred loans and lenders are regulated. Nonetheless, they remain legal and widely available.

How do payday loans in Kansas work?

The process involves providing proof of income and an active bank account. The lender sanctions a loan at a fixed fee based on the borrowed sum. The entire loan and fee is payable on your next pay date, which generally sets the loan duration to be 7-30 days.

What are the interest rates on payday loans in Kansas?

Awareness of the rates is necessary for anyone needing a payday loan immediately. On average, payday loan APRs hover around 391% in Kansas. The upfront cost to borrow $100 is $15. Rates increase exponentially if you don’t pay the loan on time and it gets rolled over.

What is the maximum payday loan amount in Kansas?

Understanding your limits is necessary to obtain no denial payday loans direct lenders only no credit check.

State law caps a typical payday loan at $500 in Kansas. Other direct loan lenders limit the loans to 30% of your steady income if this amount is lower than $500, which is especially viable for people needing extra cash due to a medical emergency or other sudden financial needs.

Do payday loans in Kansas be rolled over?

Yes, Kansas permits payday loan online renewals or rollovers. There is no limit to how many times a borrower is able to roll over the same loan, which leads to many falling into cycles of debt, a situation that is not a beneficial long-term financial solution.

Do payday lenders in Kansas do credit checks?

No. 1 hour payday loans no credit check are an option. The lenders usually only verify your income and bank account, and you must not have outstanding loans in default. They prioritize the instant decision process over hard credit checks.

How long do you have to repay a payday loan in Kansas?

Loan process terms for payday loans are generally from 7 to 30 days in Kansas. The due date is tied to the borrower’s next payday, offering instant access to funds. Longer repayment plans are available after numerous renewals.

Am I able to have more than one payday loan at a time in Kansas?

No. Kansas prohibits lenders from issuing a new loan if an existing payday loan is outstanding. Qualified applicants take the rollover option for the same loan multiple times because it is easy to request a fast loan in Kansas.

Do online payday loans operate in Kansas?

Yes. Kansas residents are able to obtain unsecured payday loans online from state-licensed lenders through an online application process. Brick-and-mortar stores are much more common, though.

We are delighted to present a comprehensive list of the key cities where our company provides payday loan services in Kansas. As a trusted financial institution committed to assisting individuals in temporary financial need, we have established a strong presence nationwide. Our dedicated team of professionals is readily available in these cities, offering reliable and accessible solutions to help bridge the gap between paychecks. Whether you reside in bustling urban centers or charming smaller towns, our company is here to serve you. Please refer to the table below to find the nearest location and discover the convenience of our payday loan services in your area.

| Wichita | Overland Park | Kansas City |

| Olathe | Topeka | Lawrence |

| Shawnee | Lenexa | Manhattan |

| Salina | Hutchinson | Leavenworth |

| Leawood | Dodge City | Garden City |

Key Takeaways: Necessary Points to Understand about Payday Loans Kansas City, KS

- Unsecured payday loans provide instant approval decision and quick access to funds but carry APRs over 391% in Kansas with the risk of entrapment in debt cycles.

- Regulations cap payday loan amounts at $500 and limit fees but permit unlimited renewals, offering financial solutions with a flexible approval rate.

- Cheaper alternatives exist, like credit union loans, paycheck advances, and payment plans.

- Borrow only what you realistically repay by the due date to enjoy an instant decision if you choose unsecured loans.

- Avoid rollovers that bring about new fees and keep you trapped paying interest.

- Address root financial problems with planning rather than payday loans. Banking on financial solutions leads to overall healthier financial health.

The Bottom Line: Concluding Thoughts on Online Payday Loans Kansas

1 hour payday loans no credit check provide an instant decision and quick access to funds; they must not be seen as a long-term financial solution. Know all your financial solutions, and you must have a steady income before entering the application process for a payday loan. Opt for a guarantee application process that suits your needs and know the approval rate you are comfortable with.

Instant cash advance for short-term up to $500 or payday loans promise a quick loan solution when financial emergencies arise. They seem like the ideal choice for immediate cash, but Kansans must know the credit limit, limited loan amounts, and hidden costs, which outweigh their benefits. Safer and more affordable types of loans exist for diligent seekers, serving a variety of purposes. These include auto loans, title loans, and more, providing a variety of loan options.

The Kansas payday loan application process is simplified by managing finances prudently and choosing the right loan provider. For individuals looking for a fast solution, online loan lenders like reputable lenders provide a convenient option with better terms and low interest. These loans to people are a more sensible alternative.

But for people with bad credit, bad credit payday loans remain the only viable option. Proceeding with this option must be done with extreme caution. Yet, rest assured that if you choose to proceed, the providers offer excellent customer service to guide you along your loan journey.