An unexpected expense or financial emergency leaves you with the dilemma, “I need a payday loan immediately.” Understanding how fast payday loans and the ripples they bring – like their high-interest rate and potential debt traps in Iowa – is necessary for making responsible financial decisions. The panacea lies in $100 loans online or even a $1000 loan online, but analyze their smokes and mirrors thoroughly.

The comprehensive guide offers:

- A spotlight on short-term lending in locales like Mason City and Iowa City

- Deconstructing payday loan costs and exposing high-interest rate and hidden fees

- Unraveling Regulations and laws enveloping the industry in Iowa

- Wise ways of utilization to avoid the booby traps of debt

- Alternatives to classic payday loans

- FAQs about the online payday loans Iowa terrain

Getting started, let’s dive into how payday loans operate.

How Do Online Payday Loans Operate in Mason City and Iowa City?

Payday loans are seen as immediate cash conduits in expectation of a full repayment with interest come your next payday. Qualification criteria involve having an ID, providing your bank account details, and assuring a dated check or electronic debit authorization for the slated repayment amount.

The whole process offers the convenience of walking out the same day with the cash and the assurance that the lenders deposit your loan proceeds into your account. In Mason City or Iowa City, you even benefit from a same day deposit.

A loan “rollover” by paying the fees and extending the due date becomes necessary if a full balance payment eludes you come payday, potentially becoming a vicious cycle of renewals and escalating costs.

In general, payday loans skitter from $100 loans online to a $1000 loan online nationally. But in Iowa, local regulations cap the amount at a $500 maximum. They run for 2-4 weeks.

What Makes Online Payday Loans Iowa in Iowa City and Mason City So Appealing with Instant Approval?

Payday loans hold an understandable appeal for people with low income, poor credit, or limited savings. They open up a gateway to fast cash infused with:

- Immediate access – Quick approval and funds deposited into your account on the same day. Availing of the services, especially when you have “I need a payday loan immediately“ situation, has been made more convenient through online services such as online loan request form which makes requests like payday loan request or applications for small payday loans online no credit check even easier through online application form.

- Fast payday loans – Targeted at borrowers in Iowa City and Mason City, borrowers gain access to quick payday loans with no credit check payday loans guaranteed approval.

- Payday loans online no credit check instant approval Iowa – For people in need of online loans, particularly online payday loans Iowa, the online service usher in online loans with no credit check.

- $500 cash advance – An occasional higher limit such as a $500 cash advance is available.

The convenience of payday loans online and payday loan online services certainly appear alluring. But understanding the associated fees and high-interest rates and smart strategies to manage them is highly advised.

- Few requirements – Just an ID, bank account, income source, and minimum earnings. No lengthy credit checks, no credit check loans, and quick approval even for bad credit loans guaranteed approval are feasible.

- Various loan options – Including cash loans, no credit check loans guaranteed approval, payday loans online same day, installment loans, and more.

- High approval rate – Approval chances are 9 out of 10 even for people looking at bad credit personal loans.

- Convenient locations – Hundreds of storefronts across Iowa and online options to borrow money online. Here you find cash advances in Iowa online, quick loans, high-risk loans, and Iowa no credit check loans.

Various kinds of loan options like payday loans online same day or no credit check loans guaranteed approval allow them to borrow several hundred dollars quickly when Iowans face an urgent need like a medical bill, major car repair, or late rent.

But convenience comes with steep finance charges.

Iowa Payday Loans Online No Credit Check Instant Approval – Interest Rates and Fees

The major downside of payday loans and bad credit loans guaranteed approval is their high cost. Iowa caps payday loan rates, which equate to a significant annual percentage rate (APR).

The maximum loan rates set by Iowa law are:

- 15% on the first $100 borrowed

- 10% on loan terms from $101 to $500

- A $15 maintenance fee apply

So, the maximum loan charge for a 2-week, is $500 cash advance loan or short-term loan in Iowa is $50. The total repayment for a $100 loan is $115 after 14 days.

Though not as predatory as states, this means payday loans for bad credit APRs in Iowa range from 260% to almost 400%, constituting a maximum interest rate. You face finance charges like:

- Insufficient fund fees from banks ($20-$40)

- Collection fees if you default on repayment

- Origination/documentation fees ($10-$30)

The costs of bad credit personal loans or best online payday loans add up quickly. So, let’s delve deeper into the associated risks.

In the ever-evolving financial services landscape, our company has established a strong presence in Iowa, providing reliable and accessible payday loan solutions. We understand the importance of addressing immediate financial needs, and our commitment to serving customers extends to various cities across Iowa. To better assist you in locating our services, we have compiled a comprehensive table showcasing the most significant cities where our company is active. Whether you reside in bustling urban centers or tranquil rural areas, our dedicated team is ready to offer tailored financial assistance. Explore the table below to discover the key cities where our payday loan services are readily available, bringing convenient solutions closer to you.

| Des Moines | Cedar Rapids | Davenport |

| Sioux City | Iowa City | Ankeny |

| West Des Moines | Ames | Waterloo |

| Council Bluffs | Dubuque | Urbandale |

| Marion | Cedar Falls | Bettendorf |

The Dangers and Debt Traps of Iowa No Credit Check Loans

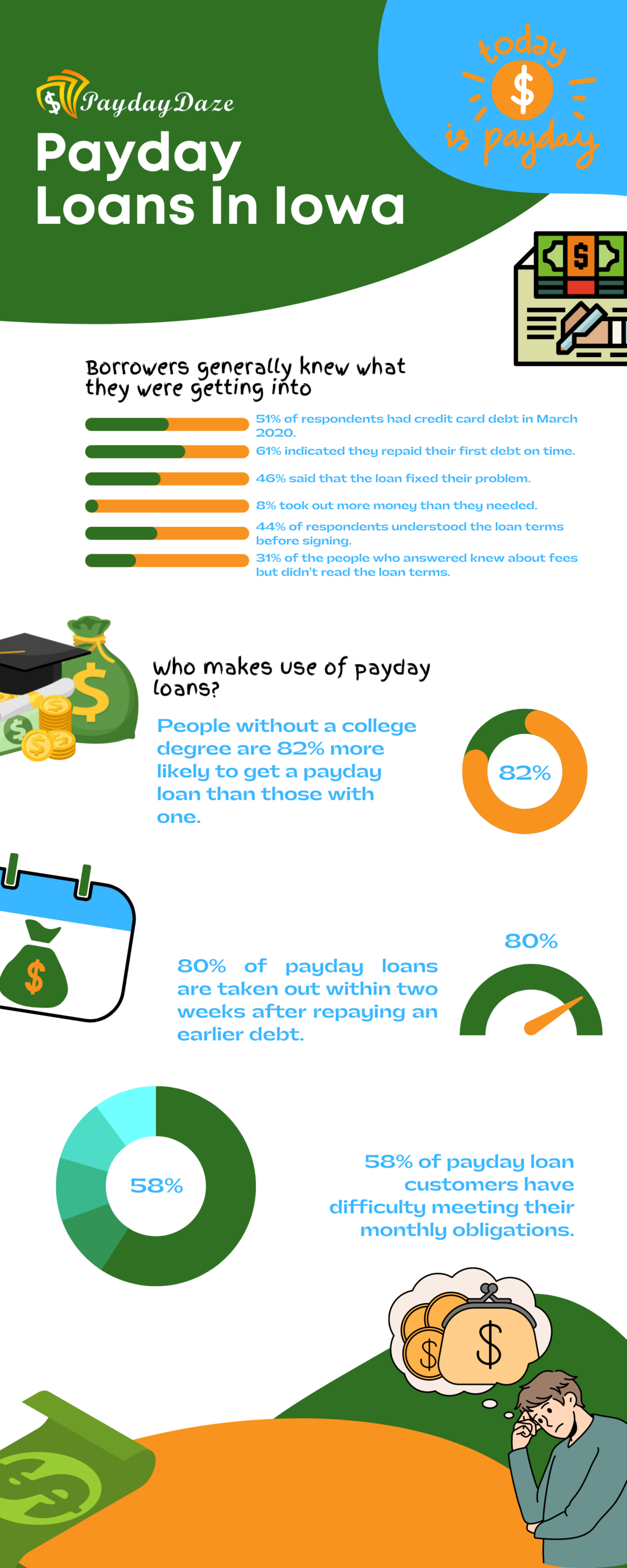

The high-risk loans such as payday loans, have high costs, leading to Iowan borrowers struggling with repayment. Consequently, they fall into cycles of debt.

According to state data, over 80% of short-term loans go to borrowers applying for 7 or more loans per year. These borrowers stay in debt for over 200 days per year.

Failing to afford the balloon payment on due leads to the rollover of loans or re-borrowing, resulting in escalating fees exceeding the original loan amount. The scenario magnifies the difficulty in paying off the loans.

Other dangers of failing to repay Iowa no credit check loans include:

- Excessive NSF fees ranging from $20-$40 by your bank for denied automatic debits

- Constant, calls and letters from loan companies handling your outstanding loans

- Damage to your credit score and rating, making loan approval harder in the future

- The threat of potential lawsuits, wage garnishment, and bank levies from lenders due to unmet obligations

These easily lead to a cycle of financial difficulties exacerbated by short-term loan options. This points to the inherent risk associated with the payday loan industry. Now, let’s look at the laws in Iowa that govern payday lending.

Iowa Laws and Regulations for Online Payday Loans Iowa

To mitigate the risks, Iowa has implemented regulations meant to protect consumers from predatory practices by payday loan providers:

- Interest rate caps – Iowa law limits interest charges to 15% or 10%, depending on the type of loan. The law is aimed at keeping astray from excessively high APRs.

- One loan at a time – Borrowers are disallowed from having multiple outstanding loans at a time. The regulation is put in place to prevent borrowing from diverse sources.

- Rollovers restricted – The loan agreement is renewed up to four consecutive times provided the borrower clears at least 5% of the balance with each renewal. The regulation curbs the drawbacks tied to serial borrowing.

- Database tracking – A state-controlled database maintains a record of loans that lenders must check to enforce limits on rollovers and simultaneous borrowing. The system streamlines the application process and ensures no state rules are violated.

- Special protections for military – The state provides special safeguards for Active-duty military, capping APR on loans at 36%.

Despite the measures, consumer advocates argue for stricter regulations, emphasizing the need to protect people with a bad credit score or people seeking a 3000 personal loan no credit check in Iowa. Iowa’s laws do provide substantial protections against predatory lending practices.

Tips for More Responsible Usage of Payday Loans Online No Credit Check Instant Approval Iowa

The wisest option remains to avoid high risk loans like payday loans completely; if you do decide to take a payday advance, here are tips to help lessen the risks.

- Go small – You must borrow a small, short-term loan you comfortably repay. Going for minimal amounts helps prevent plunging deeper into debt.

- Develop a solid repayment plan – Your budget must include a definite repayment plan and confirm your next paycheck covers the loan amount and your regular expenses.

- Understand your loan agreement – Carefully peruse your loan offers to know when repayment is due and how to avoid unnecessary fees.

- Avoid rollovers – Prioritize paying off the full balance by the due date to avoid renewals and charges.

Obtain your loan from Reputable lenders who meet the credit score requirements and are transparent throughout the application process. Know other options before resorting to payday loans.

- Take it merely a temporary solution – Have an effective financial solution plan to avert the need for instant payday loans in the future through monthly savings or an improved credit history.

- Steer clear from multiple loans – It’s illegal in Iowa and leads to spiraling, unmanageable debt. Avoid additional charges.

Smart borrowing practices, stringent limits on usage, and finding a suitable lender make payday loans less risky and more manageable in a true emergency. Know your monthly income and the maximum loan term while borrowing. Up next, let’s explore alternatives.

Alternatives to Online Payday Loans Iowa

The ideal approach is eschewing payday loans outright. Here are emergency resources to ponder upon with a poor credit history or bad credit history issue:

Credit union payday alternative loans (PALs) – Numerous Iowa credit unions propose PAL loans at a low-interest rate of 28% APR with monthlies over 1-6 months to members who provide Proof of Income, have a direct deposit, and a credit union account history. This is different from the situation observed in nearby states such as Minnesota, Wisconsin, Illinois, Missouri, Nebraska, and South Dakota.

Borrow from trusted ones – For people blessed with helping relatives or friends, a minor personal loan with defined repayment terms evades huge fees. It is an unsecured way of borrowing that doesn’t require a formal loan application like a bank loan.

Low-rate credit cards -Still carry an ongoing interest. Yet, credit cards provide rates far below payday loans for urgent expenses to people who qualify based on their regular income.

Negotiate bill payments – Directly contact utility companies, landlords, auto mechanics, and healthcare providers, explain your financial hurdle, and ask for personalized payment plans. Most are understanding.

Sell unwanted possessions – Mull overselling gently used electronics, jewelry, musical instruments, or other valuables through Craigslist, eBay, pawn shops, and consignment stores as a different source of income.

Part-time gigs and side jobs – Signing up for a rideshare service is an effortless way to bring in extra cash when needed promptly.

Many options exist beyond predatory payday loans. Use the alternatives before resorting to lenders within a network of lenders.

Payday Loans Online No Credit Check Instant Approval Iowa Frequently Asked Questions

Let’s conclude with responses to regularly asked queries about the payday loan in Iowa:

Are payday loans legal in the state of Iowa?

Payday lending is legal and supervised in the state under Iowa Code 533D. Direct lenders offer low-cost payday loans and have to register and comply with interest caps and consumer protection policies. Expect Instant decisions and Instant approval decision after a soft credit check.

What are the requirements to qualify for a payday loan in Iowa?

To qualify for a payday loan or a larger loan in Iowa, applicants must be a resident over 18 with a government-issued ID, an active checking account with an active bank, a steady income of at least $800-$1000 per month, and a verifiable phone number. Suitable contact details, including a current email address, are required for communication purposes. Both online and retail lenders operate within the state, and many offer 1 hour payday loans no credit check. The offering of instant cash loans, including title loans, among financial institutions is not uncommon.

What is the maximum payday loan amount allowed in Iowa?

In Iowa, state law caps the maximum loan amounts at $500. Other lenders provide no denial payday loans direct lenders only no credit check with lower limits, especially for first-time borrowers. The minimum payday loan usually costs $100 but requires basic personal details, if required, a Social Security Number.

Am I able to have more than one payday loan at the same time in Iowa?

Borrowers cannot have more than one payday or emergency loans simultaneously in the state of Iowa. The Iowa Attorney General’s office enforces this ban to prevent low interest multiple loan scenarios that lead to severe financial distress.

What must I do if I can’t repay my payday loan in Iowa?

It’s imperative not to ignore communication from your lender if you cannot repay your payday loans or no denial payday loans. Contact the lender immediately and share your situation. Many lenders help arrange feasible payment plans or extensions if they see you being proactive about your inability to repay.

Do payday lenders in Iowa check credit reports?

Many payday lenders in Iowa conduct a soft credit inquiry that doesn’t affect your credit score to confirm your identity. But hard credit checks are rare. They offer credit check installment loans. Bad credit doesn’t prevent approval as long as one fulfills the basic eligibility requirements. The entire online loan request process includes instant approval and is very helpful if you need money now.

Do payday lenders in Iowa garnish my wages if I default?

Payday lenders in Iowa garnish your wages upon defaulting on a financial product if they sue you for defaulted debt, win a judgment, and pursue wage garnishment orders against your employer, which means up to 25% of your paycheck withheld to repay your loan.

Hence, avoiding payday loans is a wise financial step. Heed the tips and answers to make responsible choices that minimize the risks of falling into debt if necessary, requiring fast emergency cash.