Payday loans allow Wyoming residents to request a $500 cash advance or a quick short-term loan through our network of lenders during financial emergencies. But how do lenders offering payday loans operate, and what are the dynamics of standard payday loans in the Cowboy State? The following comprehensive guide covers everything you need to know about quick loans in Wyoming, the best online payday loans, and how cash loans operate.

What Are Payday Loans? Online Payday Loans Wyoming Explained

Payday loans, frequently referred to as cash advances or payday advances, are a form of short-term borrowing where a lender provides a small loan, usually within the bracket of $100 to $1,000, to be repaid on the borrower’s next payday. Payday loans online fast results can enable acquiring a $1000 loan online or sometimes even more.

Such quick payday loans adhere to the traditional dynamics of short-term loans: they are meant to be repaid in full on the next payday, 2 to 4 weeks later. The full loan balance, along with the fees, is due at one time, making it quite a substantial amount. Payday loans have high-interest rates, with an average APR of 400%. States such as Montana, Colorado, Nebraska, South Dakota, Idaho, and Utah have already set protective boundaries for their borrowers.

The best online lender network requires borrowers to provide a post-dated check or electronic debit authorization for the full loan amount and fees. The check or authorization is either cashed on the loan due date or the funds are withdrawn from the borrower’s bank account. Borrowers opt for payday loans as they require minimal paperwork and provide access to funds quickly. The fees and short repayment terms usually lead consumers into a cycle of persistent debt.

Comprehensive Guide on Wyoming Payday Loan Laws

Wyoming payday loan laws permit payday lending under the state’s “Uniform Consumer Credit Code.” Online payday loans in Wyoming are less restrictive than in many other states. A couple of terms are essential to take note of:

- No maximum loan amounts – Lenders offer loans online in any amount. Advertised loans up to $3,000 are common.

- No limits on interest rates – Annual percentage rates (APR) range from 300% to 900%.

- No limits on repeated borrowing – Borrowers obtain unlimited back-to-back loans.

- Electronic databases not required – Lenders don’t have to verify borrowers’ other outstanding loans by completing a loan request form and submitting a loan request online.

The emergency expenses seem suffocating, but the solution isn’t consistently a payday loan. Understanding all aspects of payday loans, their implications, and the laws surrounding them is necessary before jumping into a commitment.

Critics contend such lean guidelines heighten hazards for consumers than states like Colorado and Montana, which cap rates and installment payments. Industry promoters contend that the open market fosters competition, offering alternatives to payday loans and accommodating people with a bad credit history.

Payday Loan Companies in Wyoming: Where to Find Online Payday Loans Wyoming

Many payday lenders, usually acting as lenders, run offline establishments throughout Wyoming. Renowned franchises possessing many storefronts comprise ACE Cash Express, Advance America, Check Into Cash, and Moneytree, all offering various types of loans, including $5,000 personal loans and short-term cash advance.

Smaller local franchises and independent lenders are prevalent throughout the state, offering services such as bad credit loans to cater to a wider population segment. Examples include Cottonwood Financial offices in Cheyenne and Casper and First Choice Loans in Riverton, which accept proof of employment history as proof of income.

Besides physical offices, many Wyoming dwellers now avail of online payday loans Wyoming. Internet-exclusive lenders outside the state boundaries, like USFinancing and WideOpenLending, offer loan options to Wyoming residents, opening doors for people dealing with medical expenses or unexpected expenses.

Online loans offer a handy substitute for rural residents or people grappling with transportation hurdles. The principal benefits comprise 24/7 access, fast results, and funds directly deposited into bank accounts. The quick funds, attained via an online loan request possibly by the next business day, adds a new layer of flexibility not offered by traditional lending methods.

Payday Loan Requirements in Wyoming: No Credit Check Loans Wyoming Eligibility

Securing a payday loan in Wyoming is relatively straightforward than orthodox bank loans or credit cards. The elemental prerequisites are:

- Identification – Government-distributed ID proving your identity.

- Income – Habitual income stream from an occupation, benefits, retirement, or other sources of income.

- Bank Account – An active checking account or a debit card where the lender deposits the cash advance loan funds.

- Minimum Age – At least 18 years of age in Wyoming.

- Contact Information – Your address, phone number, and email address.

A key element is that payday loans online in Wyoming do not demand a credit report or score check. They verify employment and income. Approval judgments are made based on your repayment capacity versus your credit profile.

The condition allows borrowers with bad credit or past bankruptcies to be still eligible. It eliminates a motive for lenders to evaluate your complete financial position.

The Payday Loan Process in Wyoming: How Wyoming No Credit Check Loans Work

Your journey most likely follows such steps if you decide to initiate a payday loan request in Wyoming:

- Loan Request – Kick-start your loan request by filling out a concise loan request form, be it in person, online, or via a phone call. Provide fundamental personal data along with employment specifics. You must provide recent bank statements as proof of a recurring source of income.

- Approval decision – The next lane in the journey involves the lender performing a swift review of your loan request and delivering fast results, usually within a few minutes. The step involves Wyoming loans even with all credit types welcome, simplifying the process for people with low credit scores, hence the term Quick loans.

- Loan agreement – You’re required to sign the loan documents, pledging a post-dated check to cover the full balance at the end of the loan term, which commonly ranges from minimum loan term of two weeks to maximum loan term of one month if your loan request carries weight and is thus approved.

- Receive funds – Post agreement, the lender promptly disburses the loan funds by transferring them into your designated bank account.

- Loan due date – The full balance is due between 2 to 4 weeks later, keeping in sync with your monthly pay date to accommodate monthly payments.

- Repayment – The lender processes your check or withdraws the repayment from your account per the established repayment schedule on the due date.

The rapid approval process and receipt of funds render Wyoming payday loans enticing for managing short-term expenses and emergencies. Comprehend the Policy Terms, particularly the repayment period and plans, before ink-filling the agreement.

Payday Loan Interest Rates in Wyoming

Payday loans in Wyoming place substantial burdens on your wallet, with annual percentage rates fluctuating between 300% to 900%:

- A $300 loan spanning two weeks with a $50 service fee denotes an APR of 653%, including finance charges.

- A $500 loan tenure of a month with a $150 service fee corresponds to an APR of 780%.

The interest rates strive to counterbalance the potential risks lenders take by extending no credit check loans in Wyoming sans extensive credit checks. Rates exceeding a substantial 500% are not out of the ordinary, yet they exceed the legal limits of neighboring states.

Online payday lenders occasionally advertise more lenient APRs, hovering around 300%. Nevertheless, such figures ordinarily presume you’ll opt for the full loan term of 12 months rather than the standard two weeks.

Payday Loan Alternatives in Wyoming: Other than No Credit Check Loans Wyoming

Critics contend Wyoming ought to enforce extra safeguards against exploitative lending. But what options do residents have beyond high-cost payday loans? Please note: submitting a loan request does not guarantee approval, as we connect you with potential lenders. A few alternatives encompass:

- Banks and credit unions – Such conventional lenders offer installment loans and lines of credit bearing significantly lower interest rates. Membership in a credit union amplifies potential extended repayment plans.

Understand the Credit score requirements for such alternatives. The prerequisites are generally more strict than payday loans.

- Cash advance apps – Earnin and Dave provide a payday loans alternative, allowing early access to your paycheck through an app. They use tips or monthly fees instead of interest rates in short-term loans. It operates like an unsecured app-based loan type without the reputation of payday loans.

- Credit cards – Many cards offer a little cash advance or balance transfers with lower APRs. Most even provide credit card cash advances as a solution to cash urgency. Use it only if you are able to pay off the balance each month, helping to maintain a reasonable loan repayment schedule.

- Select loan from family and friends – For small amounts, a select loan from someone you know charges little or no interest. The method acts as an emergency loan during times of need but makes formal repayment plan agreements to maintain good relations and have organized loan payments over a reasonable period.

- Paycheck advances – Employers provide emergency loans through one-time or recurring paycheck advances as an employee benefit. You get to repay it in time payments, offering a convenient channel to cash without any financial strings of no credit check loans in Wyoming.

- Payment plan with creditors – Contact vital creditors like utilities, rent, auto loans, or medical providers to request a repayment plan for bills you can’t cover. It offers a tailored financial solution to help you manage your credit effectively over a period of time.

The above options are safer, but you must still qualify if your credit score or income needs improvement. Developing your credit score over a period of time increases your chances to engage with lenders not connected to any reputation of payday loans.

Payday Loans Impact on Wyoming Communities: Social Implications of Payday Loans Online Wyoming

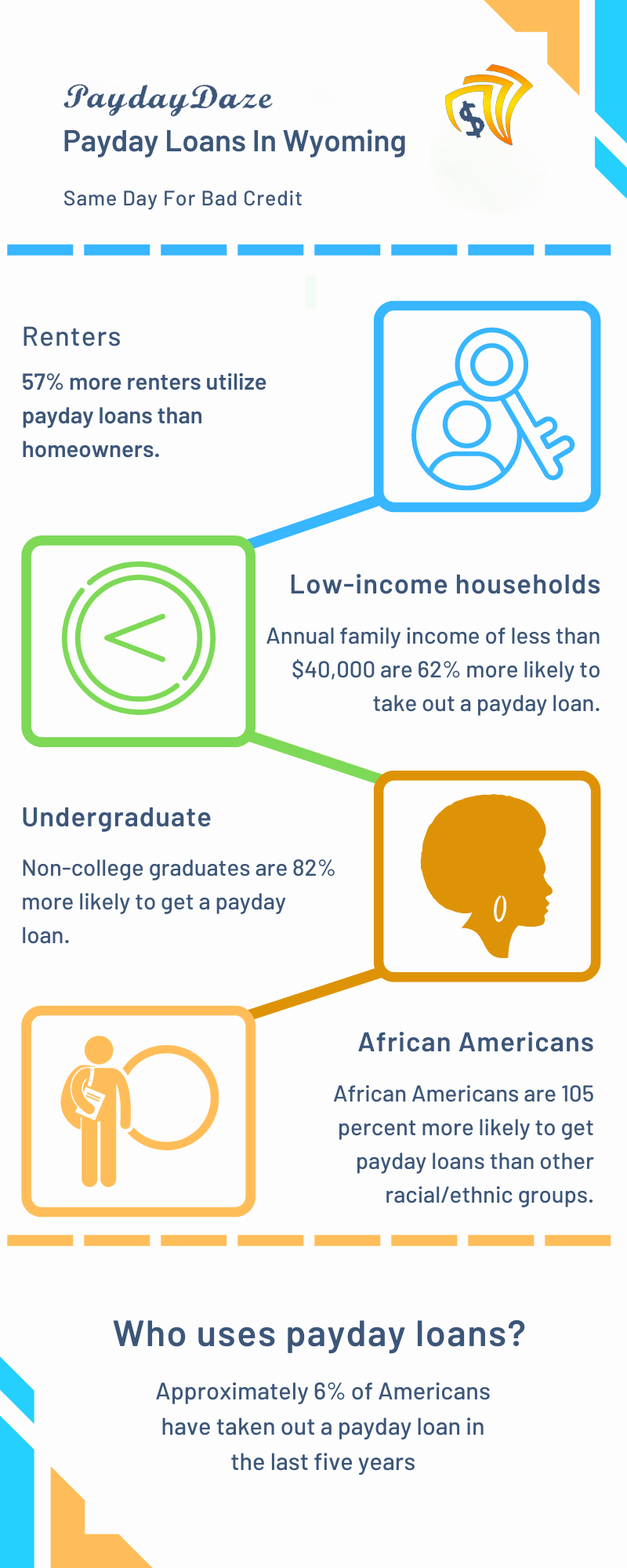

Studies have shown that payday lenders usually target communities with economic challenges:

- The type of loans offered by payday lenders is usually seen 5 times more often in minority neighborhoods in Wyoming than white neighborhoods, affecting Hispanic and Native American communities quite significantly.

- The frequency of loan types, such as payday loans, is highest in counties with military bases like F.E. Warren AFB, adversely affecting military families.

- Workers in the tourism, agriculture, and mining industries frequently utilize payday loans. The sectors usually have seasonal or inconsistent income streams, making the type of loans from payday lenders a convenient, albeit potentially damaging, financial solution.

- Wyoming’s vast geography and lack of public transportation make accessing traditional loans or other types of loans time-consuming and difficult, especially on rural Native American reservations.

So, while payday loans provide necessary credit access, they sustain poverty cycles in vulnerable populations. More informed regulations on lender practices improve outcomes.

Data on Online Payday Loans Wyoming

Despite the criticism, the demand for fast payday loans such as cash advance loans and quick payday loans still makes Wyoming a notable spot for the credit source. Here are vital statistics reported by state agencies, which underline the reliance every Wyoming household has on the loan agency.

- Over 200 payday lender locations currently functioning.

- In 2020, licensed lenders issued over 426,331 loans, many with a fast results feature.

- A striking loan volume exceeded $197 million in 2020. Many borrowers who need money now opt for payday loans for bad credit.

- The average loan was for $462, with a maximum term of 17 days to maturity.

- Each borrower relieved their finances by taking 3 loans per year.

- Wyoming households collectively paid over $52 million in interest and fees, showing the necessity for time to time cash injections.

Painting a vivid picture with such statistics, it’s easy to understand the vast dependence on payday loans among Wyoming households, and the average annual interest paid of $520 illustrates how challenging it is to break free from the debt cycle.

Beware of Scams in Wyoming No Credit Check Loans

Even though licensed lenders must adhere to Wyoming laws, illegal scam operations usually exploit desperate borrowers. Keep an eye out for:

- Upfront fee scams – A lender promises fast results and approval after an upfront “verification” or “processing” fee is paid and vanishes.

- Debt elimination scams – A company purports to negotiate with your lender to wipe off your loans for a hefty upfront settlement fee but does not provide any service.

- Phishing scams – Scammers impersonate a licensed lender’s web platform and branding and use personal information to commit identity fraud or steal money.

- Advance fee loan scams – Unlicensed online lenders give a guarantee of no credit check loans, but they demand upfront “fees” that borrowers pay and never end up receiving the loan.

Confirm the financial institution‘s licensure, comprehend the contract, get written promises, and guard against making upfront payments before receiving your funds to eschew scams.

Frequently Asked Questions About Payday Loans Online Wyoming and Wyoming No Credit Check Loans

Are payday loans legal in Wyoming?

Payday lending, including the ones who need a payday loan immediately, is lawful in Wyoming, and the state imposes fewer constraints than many others. There are no limitations on fees or loan amounts regarding short-term options.

What is the maximum payday loan amount in Wyoming?

It depends on the average credit score of the borrower and the need to avoid penalties by paying the time without penalty. There are no specific caps on the amount you borrow as long as it’s within the payday lender’s rules and regulations. The loan request process generally involves a direct deposit into the borrower’s account post-approval. A competent loan agency is committed to helping you make informed decisions throughout the loan request process.

Can you have more than one payday loan in Wyoming simultaneously?

Yes, with no credit check loans (all credit types are welcome), there are no restrictions on having multiple outstanding payday loans with different lenders. Such freedom enables Bad credit borrowers to secure more than one loan at a time, leading a few into deeper debt. The legal resident must use the loan proceeds wisely, knowing it must be a long-term solution rather than a short-term fix.

Do payday lenders in Wyoming check your credit?

No, our partner lenders only confirm your identity, income source, and bank account. They do not conduct credit checks or report loans to credit bureaus. Instead, they perform a soft credit check, offering bad credit loans with fast results (approval is not guaranteed) while maintaining your credit score.

How long do you have to repay a payday loan in Wyoming?

The maximum repayment term in Wyoming is one month, as per law. Most payday loans have terms of 7 to 14 days, aligned with the borrower’s pay cycle. Funds are typically deposited by the next business day, ensuring timely access to the funds, and helping borrowers fulfill their immediate financial needs.

Can payday lenders in Wyoming garnish your wages if you default?

Yes, with internet access to pertinent legal information, they sue in small claims court and garnish your wages to recover unpaid loan balances and extra fees.

What interest rate are you charged on payday loans in Wyoming?

APRs range from 300% to 900%, but there is no legal limit on payday loans in Wyoming. Online loans and Installment Loans extended by our marketing partners advertise lower rates and present more affordable borrowing options.

Can you extend or roll over a payday loan in Wyoming?

No, rollovers are not permitted. You must fully repay the existing loan before obtaining a new one or count on title loans. There is no limit on back-to-back loans. Hence, you must complete the simple loan request form correctly, ensuring your financial capacity aligns with the repayment schedule.

Are online payday loans legal in Wyoming?

Yes, online lenders from other states issue payday loans to Wyoming residents. You can submit a loan request online, by phone, or through a mobile app, reassuring the ever-present convenience of the internet.

What happens if you default on a Wyoming payday loan?

The lender tries to cash your check or debit your account. They contact your employer to garnish wages or take you to small claims court to attempt to collect if that fails.

Final Thoughts on Online Payday Loans Wyoming

- No denial payday loans from loan-connecting services (no credit check, all credit types are welcome) offer fast access to credit but usually include high interest rates.

- Nonetheless, in Wyoming, the rules are more flexible, with no limits on service fees or payday loan amounts, even for $100 loans online.

- You must choose stable alternatives before settling for a small payday loan online (no credit check, all credit types are welcome).

- Reading agreements meticulously and ensuring the lenders are licensed is necessary to a secure loan request before authorizing access to your bank account.

- You must resist predatory lenders attempting to exploit vulnerable groups, including the military.

- No credit check payday loans (fast results, but approval is not guaranteed), and 1 hour payday loans (fast results, but approval is not guaranteed) must be contemplated solely for real short-term crises. You must have a solid repayment process, such as installment loans, as a part of your pricing plan.

In the expansive serenity of Wyoming, it’s worthwhile to be a savvy customer when your budget feels too restricted before the next payday arrives. Stick to the advice in the guide to make astute financial decisions for you and your family. In spite of stunning perspectives and self-reliant residents, Wyoming keeps on prospering as its inhabitants steadily build their monetary stability and wellness, aided by instant cash loans (fast funds, though approval is not guaranteed) and Money Offers of low interest, small payday loans online (no credit check, all credit types are welcome), and no credit check loans (fast results, but approval is not guaranteed).