Most of us know what it feels like to need quick funds. Even those with a steady income and regular paychecks can find themselves in a financial emergency when they require money quickly and without hassle.

With Paydaydaze’s simple and convenient online loan requests and fast results, you can begin the process to be connected with lenders offering Colorado Payday Loan Regulations-compliant payday loans in Colorado as soon as possible!

Loans for payday are available in Colorado(CO), which is why you should consider them.

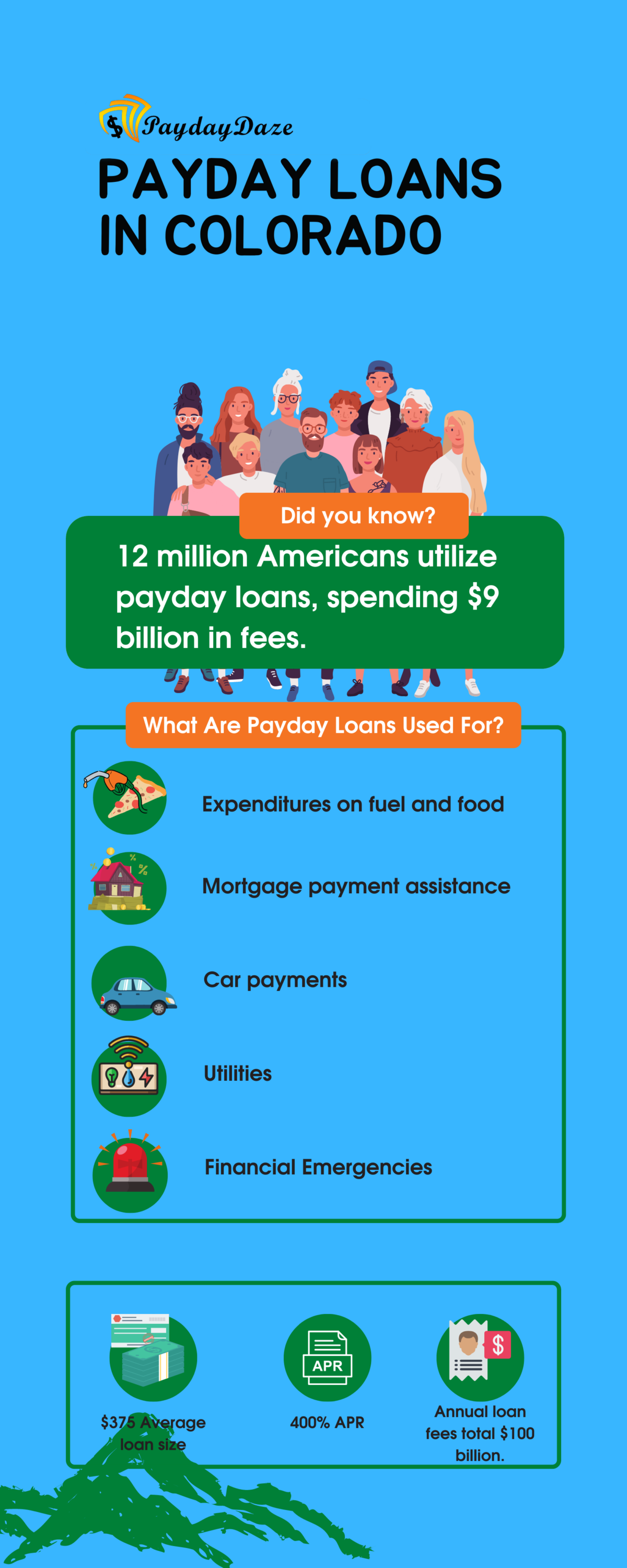

Unsurprisingly, the popularity of payday loans is at its highest. Despite the negative and positive opinions, they are ideal for managing your budget and short-term financial needs.

A constant funds shortage can be more damaging than a one-time requirement for more money. However, the short-term loan’s most significant benefit is that it assists you in simultaneously eliminating both issues.

With the convenience of online loans and loan requests, obtaining a payday loan online is now straightforward. Take advantage of these resources to help you navigate any unexpected financial situations.

What are payday loans, their purpose, and how do they function?

It’s easier to escape circumstances when you have a good credit score. It is imperative to pay the balance as quickly as you are able. If you cannot pay the required amount, you can request in advance payday loan advances provided by lenders online.

In contrast, to installment loans, payday loans are the funds you can receive from our network of payday loan providers to cover personal costs when you need financial assistance.

Based on the area that you reside in and the state you live in, payday loan alternatives might also be available. The loan terms and percentage rates for the state of Colorado could differ.

Reasons To Request a Colorado Payday Loan Through Paydaydaze

There are an infinite number of reasons you require extra money. However, if you’ve been in one of these scenarios, Paydaydaze assists you by connecting you with lenders offering payday loan advances when you need it the most.

- The bank you visited didn’t offer the loan funds. There is no way for people to avoid the possibility of a financial crisis in their own lives. The problem is that getting a bank loan or a modification to your mortgage is challenging and could take months or more to convince the lender. A quick loan to cover short-term purposes, such as paying for your rent or mortgage costs, is much faster. Most traditional financial institutions might be more hesitant to provide loans if you have a poor credit score.

- You are struggling to pay your bills, rent, and food. This is the primary reason you’ll need a short-term loan’s help. Around 70% of the people in America take advantage of small loan advances to cover their daily costs or to meet consumer demands. These costs include credit card bills, utility bills, rent, food, and other essential expenses. Borrowers are constantly in shortage and rely on loan funds to pay their costs with a manageable monthly payment.

- Credit card debt. You know how credit card companies collect money. Five times a day, you get threatening letters until you pay. Paydaydaze can help alleviate that burden. Your credit card might max out. Overdraft costs may be covered with a loan advance. Two benefits of payday loans are the ease of securing funds from financial institutions and managing the monthly payment.

- You can’t borrow from family and friends. Some individuals hesitate to ask family for money. Online payday loans in Colorado (CO) will help you borrow funds without involving your family. This is an alternative to borrowing from financial institutions that might judge you based on your poor credit score.

- It is necessary to settle an obligation that could be costly if you don’t make the payment. Based on your agreement with other creditors, you could be penalized significantly or lose your possessions—like appliances for your home or even your car—if you fail to pay. In such situations, the interest you’ll need to pay is manageable compared to larger credit card debts. Acquiring loan funds with a manageable monthly payment may help avoid these issues.

Paydaydaze Connects You with Lenders for Installment Loans for Bad Credit in Colorado

Do you require a quick loan advance? Request via our online loan request form within just a few minutes.

You can access a range of options for Colorado Springs installment loans. Find competitive deals on Paydaydaze.com. Sign your loan agreement online and have the funds transferred to your bank account in just one business day.

It’s easy to get a Colorado payday loan. All you need to do is satisfy the eligibility criteria and understand the regulations. This will allow you to benefit from available payday loan options.

The Advantages of a Colorado Payday Loan at Paydaydaze

Here are some benefits that you can enjoy when you select Paydaydaze:

- Smooth application process: Quickly complete the online loan request form and submit it to begin your loan request.

- Meeting eligibility criteria: Our services cater to many customers, even those with bad credit scores.

- Convenient repayment periods: Choose from various repayment periods that work best for your financial situation.

- Access to loan-matching services: Get connected with suitable lenders based on your financial profile.

- Assistance during emergency financial situations: Obtain quick funds when needed, ensuring your financial stability.

- The simple online process offers quick and easy loan requests. When every second is important, you can complete our loan request form in as little as two minutes.

- Rapid loan decision process. When you work with Paydaydaze, our service connects you with lenders, and if approved, funds are transferred to your active bank account by the next business day. Whatever city you reside in when you join Paydaydaze.com, we use your bank account information to expedite the process. Once your loan request is completed and the transaction finalized, you can expect the funds after 24 hours.

- Request anywhere, anytime, and assess your financial position. No more worries, such as “Where do I find a top payday loan in my area?” You can use our online payday loans in Colorado directly from your office, home, restaurant, workplace, or anywhere. All you require is a smartphone or a computer with internet access. We’ll transfer funds to your active bank account if your loan request is approved.

- Transparent agreements and minimum loan term options. Transparency of all transactions and contracts is our priority, so you can be confident that each cent you pay is accurately calculated. With our competitive fees and minimum loan term options, we strive to ensure you’ll be satisfied with our services and your overall financial position.

When your finances are too tight to buy groceries or if you experience a car accident resulting in a large repair bill and unexpected medical bills, complete the online loan request form at Paydaydaze. We will help connect you with lenders to address your financial situation.

As a leading provider of payday loan connecting services in Colorado, our company is dedicated to serving the financial needs of individuals across the state. We understand that unexpected expenses can arise, and our goal is to offer accessible and reliable financial solutions. With a strong presence in several key cities, we proudly extend our services to residents needing short-term financial assistance. The following table highlights the most important cities where our company operates, enabling us to provide quick and convenient payday loan options to customers throughout Colorado.

| Denver | Colorado Springs | Aurora |

| Fort Collins | Lakewood | Thornton |

| Arvada | Pueblo | Westminster |

| Greeley | Centennial | Boulder |

| Longmont | Castle Rock | Loveland |

What Are the Benefits of Colorado Payday Loans?

Here are five reasons you can benefit from Colorado payday loans:

- Lenders for payday loans are available, providing multiple loan options to choose from 24/7.

- Enjoy rapid loan funding, allowing you to address urgent financial needs.

- Benefit from a high acceptance rate, making qualifying for a loan easier.

- Opt for day payday loans when you need short-term financial assistance.

- Access online lenders easily, allowing you to apply and receive funds without leaving home.

- Funds will be available quickly with flexible loan amounts. If you’ve noticed, traditional financial institutions may take days before you access your money. If you need funds immediately, our network of trusted lending partners offers a streamlined loan request process and a speedy loan decision. This allows you to have funds transferred to your bank account by the next business day when requesting Colorado payday loans through Paydaydaze.

- You can use this type of loan for various needs. After you’ve received the funds, you can use them to purchase anything you wish. However, requesting two loans simultaneously is not recommended since repaying multiple loans may be challenging. You can take out a second loan the following month with a maximum loan term once the prior one is paid off.

- All credit types are welcome on such loans for people with low credit scores or for bad credit borrowers. If your credit score has improved recently, you can still obtain a loan from Colorado. Every payday lender reviews your ability to repay the loan without solely considering a poor credit history.

- It is always possible to rely on a lending partner through our network. If you’ve fallen into a financial crisis and have no choice but to request an advance loan to organize your finances until your next paycheck, consider requesting payday loans online with a loan process that is simple and user-friendly.

- Quick and straightforward loans cater to bad credit borrowers. They don’t require an excellent credit score. Everyone who meets the criteria stipulated by lenders is eligible for a loan.

The Costs and Regulations Of Colorado Payday Loans

Here are what costs potential borrowers could expect when requesting a loan type like payday loans online in Colorado:

- Finance Charges. The maximum finance charge allowed in Colorado is $60 per $300 loan.

- Maximum APR. If you take out a 14-day $100 loan, the highest annual rate you can expect is 309%.

- Acquisition costs. If the sum of payday loan products is between $30 to $100, you could expect a legitimate acquisition fee equal to one-tenth of the payday loan amount. If the loan is more than 100 dollars, your acquisition fee is less than $10.

- Maximum amount. The maximum amount on loans for customers for payday loans in Colorado is $500.

- Maximum term. The period of time or conditions for payday loans in Colorado(CO) range from one week to 31 days.

What You Need to Do to Get a Payday Loan in Colorado

When requesting a payday loan in Colorado, it’s essential to remember the possible payment amounts and the consequences of any late payments. This way, you can make an informed decision and choose the best option for your financial needs.

With Paydaydaze, it’s easy to request a quick loan in Colorado. However, you’ll need to know the specific conditions to complete your loan request.

- It is essential to be 18 years old or older. Loan requests are only available to individuals of legal age in the USA.

- You must be a legal resident of Colorado. You must prove your residency with contact details to complete your loan request. Once you have that, the likelihood of receiving a loan offer increases.

- Your bad credit is not a problem, but you require a steady source of income and must earn a minimum of 1,000 dollars per month. This helps lenders ensure that you can handle the minimum payment. It’s crucial to note that no minimum credit score requirement exists to qualify for these loan options.

- We connect borrowers with lenders offering loans for individuals from various financial backgrounds. All you need to do is fill out the loan request form on our website.

- You must have a valid checking account to process the loan, an active phone number, and a valid email address so that lenders can contact you regarding your loan request.

- Finally, it would help if you were not a bankruptcy debtor.

All we require from you is some personal information, such as your social security number, name, and address, and you must specify how much you wish to borrow. We cater to permanent residents and aim to provide quick results on loan offers for residents.

Once you have provided us with the necessary information, we will follow up with you after the details are reviewed to confirm the conditions and terms of the agreement. Our funding process and loan decisions are fast and efficient, ensuring prompt consideration of your request.

A loan advance of a small amount can be a practical and valuable asset in emergency circumstances. However, these kinds of loans cannot fix major financial issues. Our loan offers include the possibility of a loan extension if required.

Taking loans from several companies simultaneously is not ideal since you could jeopardize your financial health.

The loan term in Colorado

No laws or norms define the loan repayment duration, but the maximum loan term is 31 days.

Suppose you compare it to the fast loans to customers available in USA states where payday loans are legal. In that case, the time is considerably longer, especially for those with a limited credit history.

The borrower from Colorado will benefit from more flexible repayment options since they can take advantage of longer repayment terms to keep their loan on track. This is due to the generous eligibility requirements of the network of lenders available on loan websites.

Prior to acceptance, grasp the terms; they might differ from traditional loans. If you need more clarification, consult a financial advisor to help you better understand the loan principal and repayment process.

Payday Loans in Colorado and Their Validity

Payday loans are legal in Colorado Springs and are regulated by the Deferred Deposit Loan Act. They are accessible through a variety of lenders, with Paydaydaze assisting in connecting you to them.

In Colorado Springs, the amount you can get via payday loans can be at most 500 dollars. The law doesn’t provide any time limits; however, the minimum term is six months. A maximum of 45 percent is allowed, and you can roll over once.

A lender connected through Paydaydaze must calculate any interest charged in a pro-rated manner when you repay the payday loan early. The loan proceeds and the remainder of the loan term will determine the amount you receive. The loan proceeds can also be used to manage your financial needs efficiently.

Conclusion

Colorado, in its move to offer better financial protection, permits payday lending but has set a ceiling at 200% APR following its reform laws. This approach differs significantly from the more relaxed regulations observed in Wyoming, Kansas, and Utah. However, the issue of some online lenders sidestepping the rules and charging higher rates remains. While a number of advocates are pressing for more robust measures and lowered rate caps, others in the industry believe the current arrangement ensures a well-regulated framework for everyone involved.

Frequently Asked Questions

Are payday loans legal in Colorado, and what are the regulations surrounding them?

Yes, payday loans are legal in Colorado but they are restricted to $500 maximum with 6‑month repayment terms. Interest is capped at 45% and fees at 20% of the first $300 borrowed.

How can I find reputable online lenders for payday loans in Colorado?

Research lenders, verify state licensing on Colorado’s official website, review the lender with the Better Business Bureau, and avoid those charging upfront fees or not disclosing rates and terms.

What options are available for individuals with bad credit seeking payday loans in Colorado?

Those with bad credit seeking payday loans in Colorado can submit a loan request through online lenders who welcome all credit types. In‑store and pawn shop loans are also available as alternatives.

What is the maximum loan amount I can borrow through a payday loan in Colorado?

Colorado limits the maximum payday loan amount to $500 by state law. Some lenders may offer lower maximums, but no lender can legally issue a payday loan exceeding $500.

What are the potential risks and alternatives to payday loans for Colorado residents with bad credit?

Risks include high costs and debt cycles. Alternatives include installment loans, credit union loans, credit cards, borrowing from family, student loan assistance, and paycheck advances.