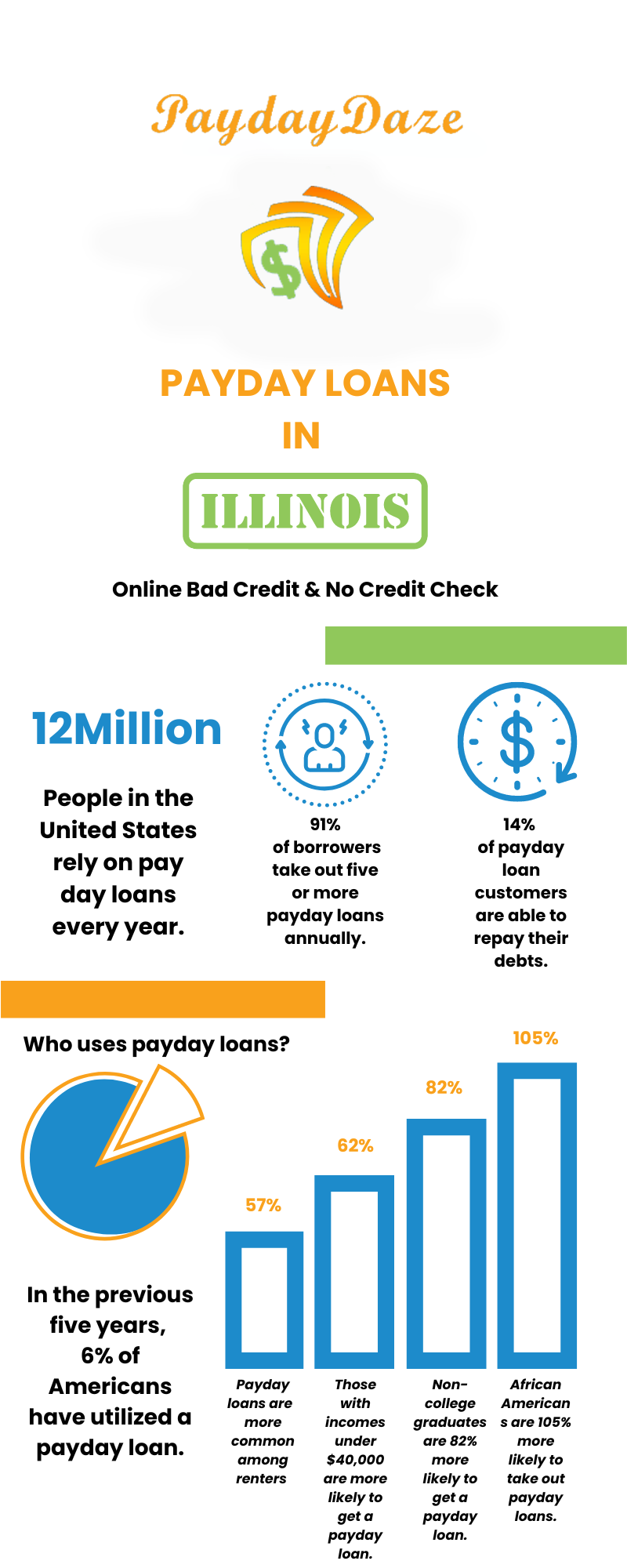

Payday loans, usually called payday advances, are a feasible option for those who require emergency cash quickly. Short-term loans are high risk loans due to their high interest rates. Known to be loans for people facing a cash crunch, they have certain risks that every borrower must understand before opting for one. The following comprehensive guide examines regulations about payday loans, costs, alternatives, and essential factors to pay heed to in Illinois, including payday loans no credit check Illinois, online payday loans Illinois no credit check, and payday loan Illinois no hard credit check.

Overview of Online Payday Loans Illinois No Credit Check, Cash Advance Loans, and More

Usually called cash advance loans, payday loans are compact, short-term loans structured to provide borrowers with quick cash in the face of an upcoming paycheck. Other terminologies encompassing such loans include deferred deposit loans, check loans, and Illinois payday loans no credit check, fluctuating between $100 to $1,000.

Numerous individuals are interested in requesting a short-term loan due to the exceptional flexibility they offer to those facing urgent financial requirements. In the event of receiving a payday loan, the borrower obliges by providing a postdated check or electronic debit authorization equating to the borrowed amount and a finance fee. The lender, in turn, holds the check until the borrower’s subsequent payday, lasting from two to four weeks. As payday arrives, the borrower retains the option to cash the check, repay the loan in cash, or merely pay the finance fees to extend the loan.

Illinois’s Payday lending is legally sheltered under the Payday Loan Reform Act (PLRA) of 2005. The PLRA introduces guidelines on loan terms, fees, and collection practices, all spearheaded towards consumer protection.

Payday Loan Regulations: Payday Loans Online No Credit Check Instant Approval Illinois

Illinois secured a pioneering role among states to implement substantial regulations on payday lending with the PLRA in 2005. Borrowers must know of a few pivotal provisions:

Loan Amount

- Incisions on payday loans don’t allow them to exceed 25% of the borrower’s gross monthly income or $1,000, whichever accounts for more.

Loan Term

- Loans are mandated to possess a minimum term of 13 days.

- The maximum loan tenure extends to 120 days (approximately 17 weeks).

Rollovers

- Rollovers, otherwise known as renewals, are discouraged. Borrowers are obligated to repay their initial loan before approaching a new one.

Fees and Interest

Several adaptations make payday loans attractive, such as fast payday loans online Illinois no credit check and direct lender Illinois payday loans no credit check. They have certain costs that borrowers must understand before delving into the process.

Lenders have the liberty to charge an acquisition fee of $15.50 per $100 borrowed for bad credit personal loans. Consequently, a standard payday loan of $300 equals $46.50 in fees.

The annual percentage rate (APR), approximately 404%, for a two-week, $300 loan with a $46.50 fee makes the usual $500 cash advance seem more pricey. This rate is higher than that of states like Indiana and Kentucky.

Default and Collections in Payday Loans No Credit Check Illinois

In default cases, lenders only charge one insufficient fund (NSF) fee of $25. It applies to no credit check payday loans guaranteed approval, and fast payday loans.

Harassment of delinquent borrowers and threats of criminal prosecution are strictly prohibited, even with no credit check loans and same day deposit loans.

Database Requirements for Direct Lender Illinois Payday Loans No Credit Check

Lending institutions must consult the statewide database before granting new loans, such as 1 hour payday loans no credit check. It register is instrumental in enforcing limits on loan amounts and the number of rollovers.

Costs and Terms of Fast Payday Loans Online Illinois No Credit Check

Understanding the standard costs and terms of quick payday loans in Illinois assists borrowers in determining the affordability of advance:

Fees

For every $100 borrowed for bad credit loans guaranteed approval, the lenders charge an acquisition fee of $15.50. It approximates $46.50 for a standard payday loan amount of $300.

The inability to repay, even for a $1000 loan online, results in one NSF fee of $25.

Interest Rates

The annual percentage rate (APR) on a standard 14-day payday loan of $300 is 404%. It is not the most accurate measure for a payday loan as the loan type is usually settled in two weeks.

For longer installment loans ranging from 3- to 6-months, the maximum APR is 99%.

Loan Terms

In Illinois, payday loans like no credit check loans guaranteed approval, and payday loans for bad credit must have:

- A minimum loan term of 13 days

- A maximum loan term of 120 days

For a standard two-week payday loan, the borrower must return $346.50 to the lender on their pay date. Here, no denial payday loans direct lenders only no credit check work similarly — the loan needs to be fully repaid at such a point, with no option for rollovers.

Borrowers must take into account the short repayment period, assessing if they are capable of meeting the loan repayment and covering other expenses from their subsequent paycheck before choosing instant payday loans.

Alternative Options to Payday Loans No Credit Check Illinois

Owing to the steep charges linked to them, prospective borrowers must explore all alternative options before settling on a payday loan. Here are a few options worth exploring:

Installment Loans

Installment loans enable borrowers to reimburse the loan in multiple payments across 3 to 36 months instead of having to refund the entire sum instantly. Though the loans carry interest, it is at a lower rate, capped at 99% APR. Loan amounts fluctuate between $1,000 and $15,000. It is a likely option for people who need financial assistance in financial emergencies.

Credit Union Payday Alternative Loans (PALs)

Many credit unions present PALs, small-sum loans with APRs capped at 28% and a mere $20 in application fees. Borrowers need to open an account with the credit union to qualify. Loan amounts range from $200 to $1,000, with terms spanning 1 to 6 months.

Employer Cash Advances

Certain employers offer their employees a cash advance on their paychecks based on hours already worked. It involves no fees or interest, only a deduction from the succeeding paycheck. Amounts range from 40-60% of current earnings.

Borrowing from Family or Friends

Borrowing money online or offline from family or friends offers interest-free emergency cash for people backed by a close network capable of extending a loan. Sketch out repayment plans.

Credit Cards

Though credit card interest rates are high, they are likely to be lower than the ones associated with payday loan fees. Be cautious not to become entrapped in debt. Confirm that minimum payments are managed each month.

Payment Plans

For costs including medical bills, utilities, or rent, inquiring about a payment plan provides more time to pay without the need to borrow the full amount upfront.

Weighing the Pros and Cons of Online Payday Loans Online No Credit Check Instant Approval

Payday loans provide swift cash but at a hefty cost. Prospective borrowers must carefully deliberate on the advantages and disadvantages of filling out an online loan request form:

Potential Pros

Applying for a loan is stressful, but with no denial payday loans, you receive instant loan approval from reputable lenders. Opt for payday loans online same day or for a “payday loan near me,” using an online form from our website for maximum convenience. We guarantee the best borrowing experience. Here are a few benefits to assess.

- The approval process becomes easier by filling out the online form for a loan application, usually only requiring a government ID, pay stub, and bank details.

- They are quick loans that make funds available in just a few hours.

- The loan approval process has minimal eligibility requirements beyond regular income.

- They offer small payday loans online no credit check for others.

Potential Cons

Despite their advantages, be mindful of the potential pitfalls of cash loans like the following.

- They have potentially high interest rates, amounting to over 400% APR.

- Quick loans have short repayment terms of around 14 days, which makes it difficult to pay off in time.

- Best online payday loans in Illinois prohibit rollovers and extensions.

- Such emergency loans lead to a debt trap if not repaid fully by the due date.

- They’re ideal only for emergencies rather than recurring financial problems.

Evaluate all the pros and cons before signing the loan agreement. The speed of instant approval and ease of online form application has high interests that make the loans risky for borrowers without steady income.

Prepare a repayment plan and assess other options before deciding on payday loans online same day.

Steps for Getting a Payday Loan Illinois No Hard Credit Check in Illinois

Follow the below steps to get one in Illinois if you still decide that a payday loan is necessary:

- Find a payday lender – Numerous storefront and online lenders are licensed in Illinois, but only opt for reputable lenders. Compare fee structures before deciding.

- Complete the application – Include details like name, source of income, contact details, social security number, and bank details in your loan application.

- Get approved – Your loan approval is instant if you meet the income and ID requirements. No credit check is required for such small payday loans online no credit check.

- Provide postdated check or e-debit consent – The lender requires a check for full repayment or electronic debit authorization for your loan agreement.

- Get your funds – Receive cash loans at low fees or direct deposits to your account, usually on the same day, with payday loans online same day. If you’re not in Illinois but require credit checks, consider cash loans from Florida.

- Repay on payday – Repay your quick loans on the agreed date, usually in 2-4 weeks. Lenders either cash the check or debit your account.

Closely review the repayment dates and amounts to avoid rollovers. Have a clear repayment plan when getting a payday loan. Payday loans and personal loans help during emergencies but require careful thought and planning.

As a leading provider of payday loans in Illinois, our company is dedicated to serving the financial needs of individuals across the state. We understand the importance of convenience and accessibility when obtaining financial assistance, so we have strategically established our presence in key cities throughout Illinois. Below is a comprehensive table showcasing the most important cities where our company operates. Whether you reside in the bustling metropolis of Chicago or the charming towns in the heartland, our team is committed to providing reliable and efficient payday loan services to help you navigate unexpected financial challenges.

| Chicago | Aurora | Joliet |

| Naperville | Rockford | Elgin |

| Springfield | Peoria | Champaign |

| Waukegan | Cicero | Bloomington |

| Evanston | Schaumburg | Arlington Heights |

Discovering Active Payday Loans Online No Credit Check Instant Approval Illinois Services

More than 550 payday lenders are currently operating in Illinois, offering different type of loan products, including $100 loans online. Suppose you need a payday loan immediately or say, “I need money now.” Here are a few tricks to discover lenders and compare their services:

- Skim through online directories such as YellowPages to find lenders within your area.

- The Illinois Department of Financial and Professional Regulation’s website lists approved lenders.

- Take a drive around your locale and keep your eyes peeled for advertisements of “payday loans,” “cash advances,” or even “instant cash loans.”

- Dig into the online space where active bank type lenders like Advance America, Check ‘n Go, CashNetUSA, and Ace Cash Express offer their services in Illinois.

- Consult with family, friends, or colleagues if they have any commendable lenders.

Keep a keen eye on their fee structures, loan products, and refund policies when engaging potential lenders. Confirm they are regulated to function in Illinois, and you are able to borrow money online without hassle, even with a poor credit score.

Evading Pitfalls with Direct Lender Illinois Payday Loans No Credit Check

Though controlled, the payday loan industry still hides a few predatory borrowing habits that consumers need to guard against:

- Avoid lenders who demand more than $15.50 for every $100 borrowed. Such charges surpass the maximum legal fee threshold.

- Shun loans whose overall charges exceed 25% of your gross monthly revenue—a legal limit on loan size.

- Evade upfront fee payments. Legitimate lenders, even the ones offering bad credit payday loans, can’t impose application charges.

- Refrain from rollover payday loans, as rollovers are illicit in Illinois.

- Never authorize lenders to access your bank accounts, even if you need a payday loan immediately. Insist on cashing the post-dated check.

- Avoid electronic signing of documents without full comprehension. Seek paper copies of all loan documents.

- Never furnish incorrect application details—it is unlawful and is a basis for lender fraud lawsuits.

- Steer clear from lenders who harass borrowers. Report any unacceptable collection approaches to regulators.

- Resorting to payday loans for recurring costs is a no-go. Search for alternatives instead of regularly requiring funds every month.

Being mindful of the rules and conducting thorough research helps secure a fair lending experience. Despite this, due to inherent risks, payday loans must only be an option for emergencies with unexpected expenses.

Payday Loans No Credit Check Illinois Frequently Asked Questions

Check the following FAQs before you submit your payday loan request form via an online application form. Even bad credit score borrowers can access payday loans, but the emphasized point is that it must not become a chronic financial solution.

Are payday loans legal in Illinois?

Yes. Payday lending is legal in Illinois but regulated under the Payday Loan Reform Act of 2005. Lenders must focus on a potential borrower’s eligibility criteria and their ability to repay the loan on time while complying with the rules concerning loan amounts, terms, and fees. It includes reviewing the borrower’s credit history and source of income during the loan request process.

How much can you borrow with a payday loan in Illinois?

Based on a person’s steady income, payday loans are capped at the lesser of 25% of such source of income or $1,000. Since they are mostly unsecured loans, lenders are cautious and set the minimum loan request amount at $100 cash advance to hedge the risk associated with a bad credit history.

How long can a payday loan last in Illinois?

Such financial products, known as payday loans, have a minimum term of 13 days and a maximum limit of 120 days, after which they must be 100% repaid without rollovers or extensions. Paying the loan on time prevents any more finance charges.

What are the payday loan interest rates in Illinois like?

Payday lenders levy up to 404% APR for a standard two-week loan. Interest rates on longer installment loans are usually capped at 99% APR for being riskier, which is a significant figure but a comparably low interest rate.

Are there payday loan alternatives in Illinois?

Yes, alternatives such as installment loans, credit union loans, employer advances, borrowing from family/friends, credit cards, and payment plans are worth exploring in cases where payday loans seem less financially viable due to their finance charges and monthly payments.

What happens if you can’t repay a payday loan in Illinois?

The lender has the right to charge a single NSF fee of $25 if the check bounces if a loan isn’t repaid on time. Unlike other states, they cannot threaten criminal charges. It is advisable to avoid lenders who harass borrowers over unpaid loans.

Can payday lenders in Illinois garnish your wages or sue you?

Payday lenders in Illinois are not entitled to garnish wages or pursue criminal charges against borrowers who default on their loans. Yet, they can send the defaulted accounts to civil collections.

How can you report a bad payday lender in Illinois?

Convenient channels are available to file complaints about predatory lending practices. You do so with the Illinois Department of Financial and Professional Regulation or the Illinois Attorney General’s office.

Do payday lenders check credit in Illinois?

Generally, payday lenders do not run soft credit checks or base approval entirely on credit scores. They verify income and bank account details and proper identification during the loan request process.

How fast can you get a payday loan in Illinois?

Payday loans, one of the expedited financial services, are generally processed swiftly, adhering to the loan request process, after successfully meeting the Eligibility Criteria and providing proof of steady income to offset the inherent risk.

One experiences the financial relief of having funds available a few hours later if picking up extra cash if approved or 1-2 business days if having to wait on a direct deposit.

Key Takeaways for Fast Payday Loans Online Illinois No Credit Check

- Installment payday loans allow fast access to cash but bear interest rates corresponding to a whopping 404% APR in Illinois, a reality that every potential borrower must assess before deciding.

- Traditional lenders and regulations prohibit rollovers and cap loan terms at 120 days, making the repayment period conservative.

- Borrow only what your financial strength is able to handle. Your income ratio plays a significant role in making your lending decision.

- Assess all alternatives with flexible repayment terms before choosing payday loans as an emergency option.

- Be proactive in researching your network of lenders, know the law, and stay clear of lending practices that don’t fulfill the minimum credit score requirement.

- Know the importance of making your repayments on time to avoid damaging your credit record with the major credit bureaus.

Final Thoughts on Payday Loans Online No Credit Check Instant Approval Illinois

Payday loans with no credit check conducted appear like a quick solution for residents grappling with financial burdens between paychecks. But Illinois borrowers must tread such waters with extreme caution, fully understanding the potential traps.

You must understand the restrictions imposed by traditional lenders limiting loan rollovers and collection harassment practices. The high fees, short terms, and risk of spiraling into a cycle of debt persist. Investigate all alternatives that contribute to your financial situation before choosing payday loans.

The following guide offers key insights into Illinois’ payday loan law, costs, alternatives, lenders, and safe borrowing practices. Evade debt pitfalls by exhausting cheaper options whenever feasible, only borrowing amounts you are sure you can repay, and using payday loans sparingly for temporary cash shortages rather than ongoing expenses. Carefully evaluate the risks before deciding if a payday loan aligns with your current financial situation.